Arguably the most famous and celebrated credit card provider in the world, American Express offers a wide selection of business credit cards.

If you qualify for an American Express card and travel frequently, or even if you simply need to spend sufficient amounts every month and have the capacity to pay your balance in full, the benefits of an American Express card are many and varied.

Featured pro tools

Spending on an Amex card leads to the award of points, and these points can be exchanged for rewards with partners.

Be wary about taking out an agreement with American Express if your business is heavily reliant on credit and will be looking to carry a balance, as this is one of the costlier lenders on the market.

American Express business credit card

- Pros and cons

- Business credit cards

- Merchant cash advance

- Business loans

- Asset finance

- Invoice finance

- Commercial mortgages

- Business vehicle finance

- American Express key information

- American Express reviews

- Business eligibility criteria

- Business finance alternatives

- Additional considerations

- FAQ

Pros and cons of American Express for business credit cards

| Pros | Cons |

|---|---|

| ✓ American Express is a globally renowned and trusted lender | ✗ Not all vendors accept American Express due to higher processing fees |

| ✓ Selection of cards available to suit different business needs | ✗ High annual fees and expenses if you carry a balance over from month to month |

| ✓ Amex points accrued through business spending can be spent on personal goods and services | ✗ Not the hardest card qualify for, but not the easiest |

| ✗ Online reviews from common providers only apply to personal cards, not business |

Business credit cards

American Express offers six types of card to business customers:

- Amex Basic Business Card

- Amex Business Gold Card

- Amex Business Platinum Card

- British Airways Accelerating Business Card

- Amazon Business Card

- Amazon Prime Business Card

Amex Basic Business Card

No annual fee, but in return, no rewards for spending – this charge card will not accrue American Express points. This card has no credit limit, instead offering ‘spending power’ based on your use and business income. Payment for any transactions must be made within 42 days of the purchase.

Amex Business Gold Card

Free for the first year, then attracting an annual fee of £175, balance on purchases must be settled within 54 days if you are to avoid accruing financial penalties. Every pound you spend earns one reward point, and you’ll be awarded 20,000 additional points every time you spend £20,000 in a quarter. Spend £6,000 in your first three months for an extra 40,000 points, with another 20,000 points awarded if you use the card after 14 months of ownership.

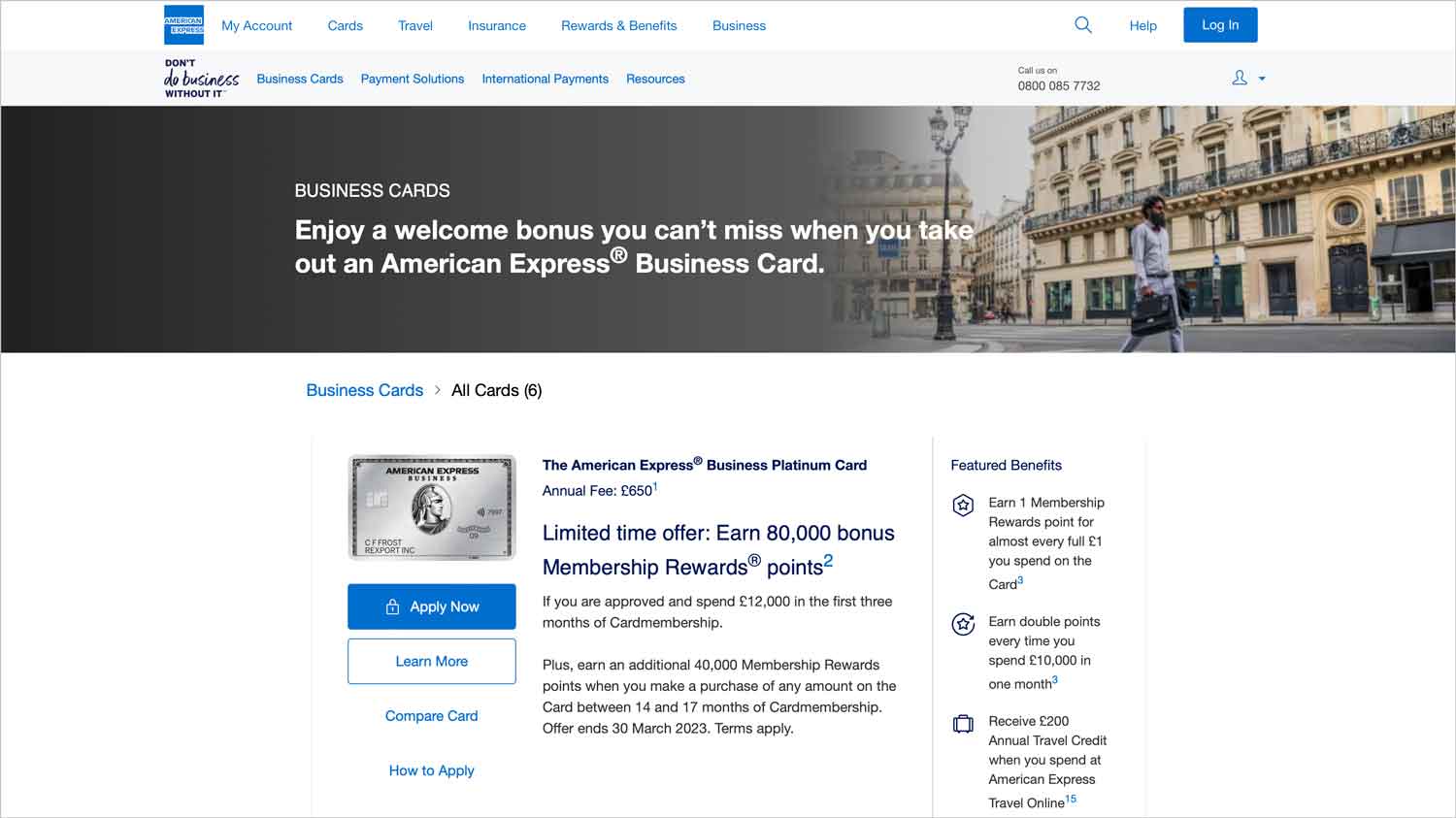

Amex Business Platinum Card

Possibly the most famous American Express card, this card attracts an annual fee of £650. Balance on purchases must be settled within 54 days if you are to avoid accruing financial penalties. Every pound you spend earns one reward point, with these points doubling if you spend £10,000 in a single month. If you spend £12,000 in your first three months you will gain an additional 80,000 points, and 40,000 more will be awarded for any spend after 14 months of card ownership.

British Airways Accelerating Business Card

Unlike most Amex cards you can hold a balance with this card, though the representative APR is an eyewatering 104.3% so you should not do so! Purchase rate is 26.3%. This card charges an annual fee of £250, but it’s ideal for frequent travellers – you will earn 30,000 Avios points if you spend £5,000 in your first month, 1.5 Avios points for every pound your spend, double Amex points on any flight booked through British Airways, and 30,000 Avios points if you spend £60,000 in a single month.

Amazon Business Card

An American Express card issued by Amazon.co.uk. This card has an annual fee of £50 (waived for the first year) and can hold a monthly balance, with a representative APR of 37.2% and a purchase rate of 26.1%. A credit limit will be assigned upon successful application. Cardholders will be awarded a £25 Amazon gift card as a welcome gift. This card does not accrue Amex points but Amazon rewards, which can be exchanged for e-vouchers on this website.

Amazon Prime Business Card

An American Express card issued by Amazon.co.uk. This card has an annual fee of £50 (waived for the first year, and every year after if you spend over £8,000) and can hold a monthly balance, with a representative APR of 37.2% and a purchase rate of 26.1%. A credit limit will be assigned upon successful application. Cardholders will be awarded a £100 Amazon gift card as a welcome gift. This card does not accrue Amex points but Amazon rewards, which can be exchanged for e-vouchers on this website.

Merchant cash advance

✗ Not available from American Express. See merchant cash advance.

Business loans

✗ Not available from American Express. See best business loans.

Asset finance

✗ Not available from American Express. See best asset finance.

Invoice finance

✗ Not available from American Express. See invoice factoring.

Commercial mortgages

✗ Not available from American Express. See commercial mortgages.

Business vehicle finance

✗ Not available from American Express. See business vehicle finance.

American Express key information

| Phone number | 0800 917 8043 |

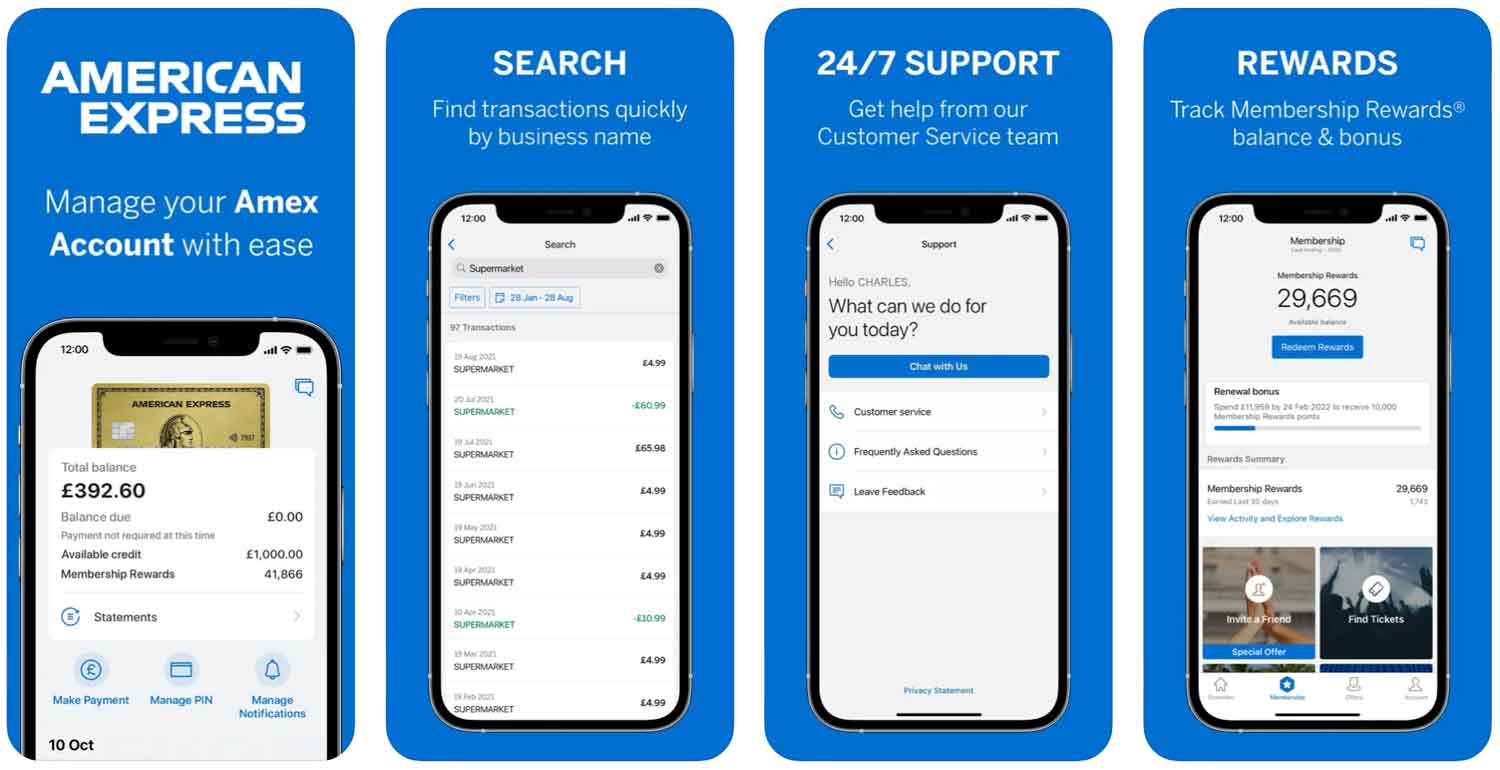

| App downloads | iOS; Android |

| Website | https://www.americanexpress.com/en-gb/business/charge-cards/ |

| Number of branches | N/A |

| FSCS protected? | No |

| Founded | 1850 |

American Express reviews

Be aware that these reviews have all been left for the personal consumer arm of American Express, and are not directly related to business credit or charge cards.

| Review platform | Score | Number of votes |

|---|---|---|

| TrustPilot | 1.7/5 | 3,082 |

| Feefo | Not reviewed | N/A |

| Reviews.io | 3.8/5 | 8 |

| Smart Money People | 4.52/5 | 52 |

| Which? | 4/5 | 1 |

| Average score | 3.505/5 | 3,143 total votes |

Business eligibility criteria

American Express does not lay down strict criteria surrounding business turnover, as the majority of the cards provided by this lender must have their balances cleared monthly. Feel free to apply for any American Express business card, but be aware that a credit check will be run immediately upon completion and this will show on your credit file.

Business finance alternatives

If American Express does not meet your needs as a business credit card, or you simply wish to compare the APR and rewards with other suppliers, consider these alternative business credit and expense cards.

- Barclaycard

- Capital on Tap

- Juni

- Soldo

Additional considerations

We hinted at this in our list of pros and cons surrounding American Express, but it’s worth noting that some smaller vendors will not accept payments from this lender, or impose a higher minimum spend, as the processing fees are higher than a Visa or MasterCard. Hotels and restaurants should not pose a problem, but be mindful of where you plan to use your American Express card.

FAQ

Applications for an American Express business credit card are handled online. Head to the American Express business website and fill in the form for the card that you are interested in.

American Express points are the biggest perk of this card. The more you spend, the more points you will accrue, and these can be exchanged for rewards with partners of Amex. For example, if you use your American Express business credit card enough, you may be able to use your points to finance a dream personal holiday without dipping into your personal income.

American Express runs an immediate credit check on all card applications and gives an answer as to whether a business qualifies within 60 seconds. If your business has experienced any kind of financial hardship in the recent past you will more than likely be denied.

This depends on how much you will benefit from the rewards offered by spending with American Express. Run a calculation on the risk vs. reward for your business and ensure that the perks outweigh the expenses before applying. £650 per year for a platinum Amex is a lot of money if you will not use the card enough to accrue many points.

Most American Express cards are charge cards, so you will need to settle your balance in full. Purchases made using the Basic Business card, for example, must be settled within 42 days, while Gold and Platinum Business cards must be paid within 54 days. If you fail to do so, you will be charged a penalty fee. The British Airways Accelerated Business card, Amazon Business card, and Amazon Prime Business card will allow you to carry over a balance, but the APR is much higher than a traditional business credit card.

American Express are a little more flexible about this than most card providers – they largely consider this a matter for a private company to deal with. As Amex balances are usually settled quickly, they are unlikely to pay much attention unless you run into financial difficulty and cannot pay your bill.