Are you looking for credit card machine rental? In the modern commercial landscape, businesses of all sizes are acclimating to the shift from cash to card transactions. Now, more than ever, having a robust and efficient payment processing system is critical to any business’s success.

This guide will comprehensively cover the essentials of credit card and PDQ (Process Data Quickly) machine rental, the different types of machines available in the market, and how to ensure you’re making the right choice for your business.

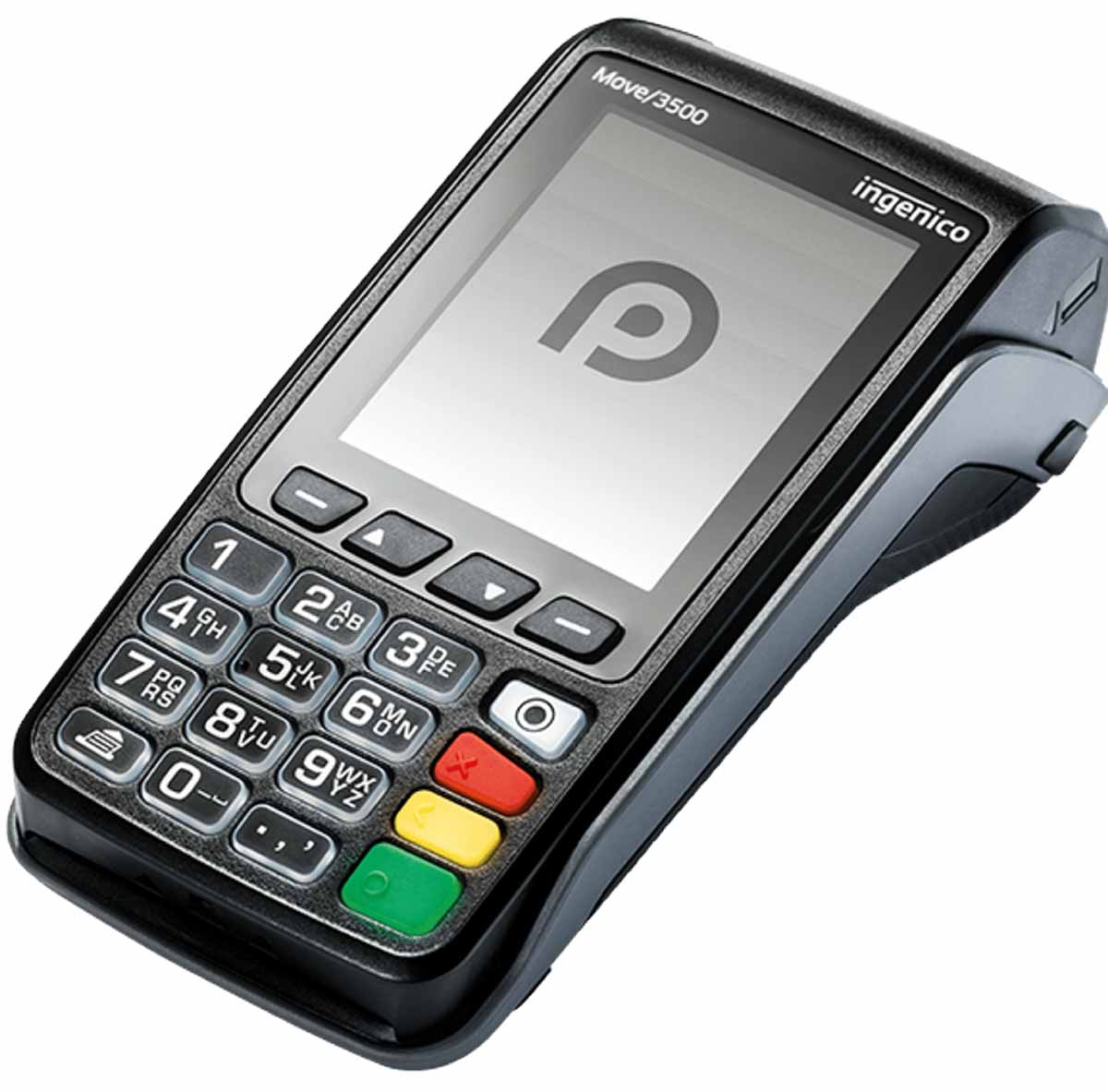

Featured pro tools

What is a PDQ machine?

A PDQ machine, also known as a card reader or card machine, is a device that processes card payments. It interacts with a customer’s credit or debit card to deduct the correct amount and transfer it to the retailer’s account.

The “Process Data Quickly” acronym quite fittingly describes its primary function. PDQ machines have evolved significantly over the years, with contactless payments and mobile integration becoming common features.

Why rent?

Many businesses opt to rent credit card machines for a host of reasons.

- First, renting can be a more cost-effective approach, especially for small and medium-sized enterprises (SMEs) or start-ups that cannot afford the high upfront costs of buying.

- Renting also offers flexibility; it enables businesses to switch machines as technology advances, ensuring they always offer the latest payment methods to their customers.

- Additionally, many rental contracts include maintenance and support, which can be valuable for businesses without the technical knowledge to manage the machines themselves.

Types of PDQ machines

There are four main types of credit card machine available for rental, each suited to different business models:

- Countertop PDQ Machines: These are the most common type and are usually found in retail outlets where all transactions occur in a single location. They’re connected to the business’s network via a phone line or internet connection.

- Portable PDQ Machines: Portable machines are ideal for businesses like restaurants or cafes, where payments may need to be taken at different locations within a limited range. These machines operate via Wi-Fi or Bluetooth.

- Mobile PDQ Machines: Mobile machines are designed for businesses on the go, such as delivery services, pop-up stalls, or tradespeople. They use mobile data or a Bluetooth connection to a smartphone to process payments.

- Virtual PDQ Machines: A virtual PDQ is essentially software that allows businesses to process card payments online. This option is suitable for e-commerce businesses.

Selecting the right credit card machine rental provider

When considering a rental provider for a PDQ machine, there are several factors to consider:

- Rental Cost: The cost of renting a PDQ machine can vary greatly. Factors influencing the price include the type of machine, the length of the rental agreement, and any additional services such as support and maintenance.

- Contract Length: Rental contracts can range from monthly to multi-year agreements. While longer contracts can reduce monthly costs, they can also limit your flexibility.

- Transaction Fees: Most providers will charge a fee per transaction, typically a small percentage of the transaction value. It’s crucial to understand these fees, as they can significantly impact your bottom line.

- Reliability: Look for providers with a track record of reliable machines and excellent customer service. Downtime can be costly, so swift resolution of issues is crucial.

- Integration with Existing Systems: Ensure the PDQ machine can integrate with your existing systems, like your point of sale system and accounting software. This will make managing transactions and financial records easier.

Best card machine rental companies compared – Top 10 UK suppliers

When renting a PDQ machine, it’s important to consider a range of providers to ensure that you’re getting the best deal. Here’s a list of some of the top credit card machine rental providers available in the UK:

Worldpay card machine rental

Worldpay is one of the largest and most established payment service providers in the UK, offering a range of card machine rental options tailored to different business needs. With competitive transaction rates and robust customer support, Worldpay is a popular choice for merchants across various industries.

- Pricing: Worldpay offers various card machine rental options starting from £15 to £30 per month, with transaction fees ranging between 1.5% to 2.5% per transaction.

- Best Suited For: Established businesses looking for comprehensive payment solutions with robust customer support.

Further information

Read our Worldpay review or visit the website.

Barclaycard card machine rental

Barclaycard is another leading player in the payment processing industry, offering flexible card machine rental solutions designed to suit businesses of all sizes. With a reputation for reliability and innovation, Barclaycard provides merchants with access to cutting-edge technology and comprehensive support services.

- Pricing: Barclaycard provides flexible card machine rental solutions, with monthly fees starting at £20 to £40 and transaction rates ranging between 1.6% to 2.5% per transaction.

- Best Suited For: Businesses seeking a trusted and widely recognised payment processing brand with tailored solutions.

Further information

Read our Barclaycard review or visit the website.

Paymentsense card machine rental

Paymentsense offers affordable card machine rental options with transparent pricing and no hidden fees. With a user-friendly interface and quick setup process, Paymentsense is a popular choice for small businesses and startups looking to accept card payments hassle-free.

- Pricing: Paymentsense offers affordable card machine rental options with monthly fees ranging from £10 to £30 and transaction fees starting at 1.6% per transaction.

- Best Suited For: Small to medium-sized businesses looking for transparent pricing and easy-to-use card machines.

Further information

Read our Paymentsense review or visit the website.

SumUp card reader rental

SumUp provides simple and cost-effective card machine rental solutions that are ideal for small businesses and sole traders. With no monthly fees and competitive transaction rates, SumUp offers an attractive option for merchants looking for a straightforward payment solution.

- Pricing: SumUp provides cost-effective card machine rental solutions with no monthly fees and transaction rates starting from 1.69% per transaction.

- Best Suited For: Startups and sole traders seeking simplicity and affordability in accepting card payments.

Further information

Read our SumUp review or visit the website.

Square reader rental

Square offers a range of card machine rental options, including the Square Reader for Contactless and Chip and the Square Stand for iPad. With its intuitive point-of-sale software and seamless integration with other business tools, Square is well-suited for businesses looking for a modern and versatile payment solution.

- Pricing: Square offers various card machine rental options, with transaction fees starting from 1.75% per transaction and no monthly fees.

- Best Suited For: Small businesses and freelancers requiring a flexible and mobile payment solution.

Further information

Read our Square review or visit the website.

myPOS card machine rental

myPOS offers card machine rental solutions with no monthly fees and competitive transaction rates. With its portable and user-friendly devices, myPOS is an excellent choice for businesses that require flexibility and mobility in accepting card payments.

- Pricing: myPOS offers card machine rental solutions with no monthly fees and transaction rates starting from 1.75% per transaction.

- Best Suited For: Businesses needing flexibility and mobility in accepting payments, including on-the-go transactions.

Further information

Read our myPOS review or visit the website.

EPOS Now payment terminal rental

EPOS Now provides integrated card machine rental solutions with its comprehensive EPOS system. With features such as inventory management, reporting tools, and customer relationship management, EPOS Now offers a complete solution for businesses looking to streamline their operations.

- Pricing: EPOS Now provides integrated card machine rental solutions with monthly fees starting at £20 to £50, depending on the chosen plan, and transaction rates from 1.5% per transaction.

- Best Suited For: Retail and hospitality businesses seeking a comprehensive EPOS system with integrated payment processing.

Further information

Read our EPOS Now review or visit the website.

Clover card reader rental

Clover offers sophisticated card machine rental options with its range of sleek and feature-rich devices. With customisable software and advanced analytics capabilities, Clover is well-suited for businesses that require a high level of customisation and control over their payment solutions.

- Pricing: Clover offers sophisticated card machine rental options with prices varying based on the chosen plan, starting from £29 to £99 per month, and transaction fees ranging from 1.5% to 2.5% per transaction.

- Best Suited For: Businesses requiring advanced features and customisation options in their payment solutions.

Further information

Read our Clover review or visit the website.

Zettle card reader rental

Zettle offers user-friendly card machine rental options with its range of affordable and portable devices. With its straightforward pricing and easy-to-use interface, Zettle is an excellent choice for small businesses and independent merchants.

- Pricing: Zettle offers card machine rental solutions with no monthly fees and transaction rates starting from 1.75% per transaction.

- Best Suited For: Small businesses and independent merchants looking for a simple and affordable payment solution.

Further information

Read our Zettle review or visit the website.

Shopify card reader rental

Shopify offers card machine rental options as part of its comprehensive e-commerce platform. With seamless integration with Shopify’s online store and other business tools, Shopify is an excellent choice for businesses looking for an all-in-one solution for their online and offline sales channels.

- Pricing: Shopify provides card machine rental options integrated with their e-commerce platform, with transaction fees starting from 1.6% per transaction and monthly fees varying based on the chosen plan, starting from £29 per month.

- Best Suited For: Online retailers and businesses with both online and offline sales channels seeking an all-in-one solution for their payment needs.

Further information

Read our Shopify review or visit the website.

Steps to renting a credit card machine

Here’s a step-by-step guide to credit card machine rental:

How to rent a credit card machine

- Determine Your Needs

Consider your business type, average transaction volume, peak transaction periods, and where transactions will occur.

- Research Providers

Look into various rental providers, considering their costs, contract lengths, transaction fees, and customer service reputation.

- Request Quotes

Contact several providers to get quotes based on your specific needs. Be sure to ask about any hidden fees, such as installation or cancellation charges.

- Compare and Negotiate

Compare the quotes and services offered. Don’t hesitate to negotiate terms; many providers are open to it, especially for longer contract periods.

- Review the Contract

Make sure to read and understand the contract thoroughly. Consider having a legal advisor review it to avoid any potential pitfalls.

- Installation

Once you’ve signed the contract, arrange for installation. Some providers offer training as part of the installation process, which can be beneficial.

Getting it right – Making a success of your first credit card machine rental

Renting a PDQ machine is an important decision with potential implications for your business’s customer experience, efficiency, and profitability.

It’s essential to do your research, understand your needs, and make a choice that provides value for money, while also meeting your operational requirements.

By doing so, you can ensure your business is well-equipped to handle the evolving payment preferences of modern customers, all while maintaining streamlined operations and robust financial tracking.

Costs and fees of credit card machine rental

Understanding the costs and fees associated with renting a PDQ machine is vital to ensure that it fits within your business’s budget and doesn’t lead to unexpected expenses down the line. These costs can be broadly divided into fixed and variable costs.

Fixed costs

Rental Fee: This is the primary fixed cost associated with renting a PDQ machine. It’s usually a monthly fee, although the actual amount can vary widely depending on the type of machine, the length of the rental agreement, and the specific provider. As of the time of writing, rental fees typically range from £15 to £30 per month.

Setup and Installation Fee: Some providers may charge a one-off fee for setting up and installing the machine. This fee is generally less common with longer-term contracts, as the provider can spread the setup costs over a longer period.

PCI DSS Compliance Fee: The Payment Card Industry Data Security Standard (PCI DSS) is a set of security standards designed to ensure that all companies that accept, process, store or transmit credit card information maintain a secure environment. Some providers charge a fee for assisting your business in meeting these standards.

Variable costs

Transaction Fees: On top of the fixed costs, most providers also charge a fee for each transaction processed. This fee can either be a flat rate per transaction or a percentage of the transaction value, and sometimes, it can be a combination of both. The specific rates can vary widely depending on the provider and the type of card being processed. Debit card transactions generally have lower fees than credit card transactions, and premium or corporate cards often come with higher fees.

Chargeback Fees: If a customer disputes a transaction (leading to a ‘chargeback’), the provider may charge a fee. This fee covers the administrative costs of handling the dispute.

Paper Statement Fees: Some providers may charge a fee if you opt to receive paper statements instead of digital ones.

Before signing a contract, it’s crucial to understand all the costs involved. Make sure to ask the provider about all possible fees and read the contract carefully to avoid any surprises. When comparing providers, consider both the fixed and variable costs and how they align with your business model and expected transaction volume.

FAQ

A PDQ machine is a device that processes card payments by interacting with a customer’s credit or debit card to deduct the correct amount and transfer it to the retailer’s account.

Renting a PDQ machine can be a more cost-effective option, especially for small businesses. It offers flexibility, allows for upgrades to newer technology, and often includes maintenance and support.

The main types of PDQ machines are countertop, portable, mobile, and virtual. Countertop machines are fixed at a location, portable machines can be moved within a limited range, mobile machines are suitable for on-the-go businesses, and virtual machines are used for online payments.

Consider factors such as rental cost, contract length, transaction fees, reliability, and integration with your existing systems. Research multiple providers, request quotes, and compare their offerings before making a decision.

The costs include a monthly rental fee, setup and installation fee (if applicable), PCI DSS compliance fee (if applicable), transaction fees, chargeback fees, and paper statement fees (if applicable).

Transaction fees are charges applied by the PDQ machine provider for each transaction processed. They can be a flat rate per transaction or a percentage of the transaction value, or a combination of both.

Yes, many providers are open to negotiating terms, especially for longer contract periods. Don’t hesitate to discuss your needs and explore possible adjustments to the contract.

PCI DSS (Payment Card Industry Data Security Standard) compliance is a set of security standards that ensure businesses maintain a secure environment for handling cardholder data. Compliance is essential to protect customer data and maintain trust.

Installation times can vary depending on the provider and the complexity of the setup. Typically, it takes a few days to a week to complete the installation process.

Yes, many PDQ machines can integrate with existing systems such as point of sale (POS) systems and accounting software. Ensure compatibility before selecting a machine.

Some providers offer virtual PDQ machines specifically designed for online transactions. Discuss your requirements with the rental provider to ensure they can meet your needs.

Rental agreements often include maintenance and support services. Contact the provider’s customer support to report the issue and request assistance.

Depending on the rental provider, you may have the option to upgrade your PDQ machine to a newer model. Discuss upgrade possibilities with the provider.

Yes, many rental providers offer options to rent multiple PDQ machines to meet the needs of your business. Discuss your requirements with the provider.

Rental providers often offer flexible contract terms that can accommodate seasonal businesses. Discuss your specific situation and requirements with the provider.

Chargebacks occur when a customer disputes a transaction. Providers may charge a fee to cover the administrative costs associated with handling the dispute.

Review the terms of the rental agreement regarding cancellation. Contact the provider and follow their instructions for canceling the rental.

Yes, many rental providers cater to businesses with various transaction volumes. Discuss your specific needs with the provider to find a suitable solution.

Rental contracts can range from monthly agreements to multi-year contracts. The duration depends on your business’s needs and the terms offered by the provider.

Switching providers during a contract term may come with certain conditions or fees. Review the terms of your contract or consult with the rental provider for more information on switching options.