A personal Barclaycard is found in countless wallets and purses throughout the UK, and the business arm of this lender is just as prominent.

Barclaycard offers a range of credit spending for a business that qualifies to borrow from this lender, and if you hold one of these cards, you’ll be eligible for a range of rewards and perks. As a global business, a Barclaycard can also be used all over the world.

Featured pro tools

Just be aware that this lender is notoriously strict on who it allows to take out a card, so only apply if you are confident that your business credit score is robust.

Barclaycard business credit cards

- Pros and cons

- Business credit cards

- Merchant cash advance

- Business loans

- Asset finance

- Invoice finance

- Commercial mortgages

- Business vehicle finance

- Barclaycard key information

- Barclaycard reviews

- Business eligibility criteria

- Business finance alternatives

- Additional considerations

- FAQ

Pros and cons of Barclaycard credit cards

| Pros | Cons |

|---|---|

| ✓ Backed by Barclays, a huge name in banking | ✗ Difficult to get – Barclaycard decline a lot of applications |

| ✓ Selection of cards available to suit different business needs | ✗ Very few online reviews – most are for a personal Barclaycard and are largely negative |

| ✓ Multiple rewards for sensible regular use | ✗ Fees and APR are not the cheapest |

| ✓ Up to 56 days of interest-free spending | ✗ Transaction fees apply if used overseas |

Business credit cards

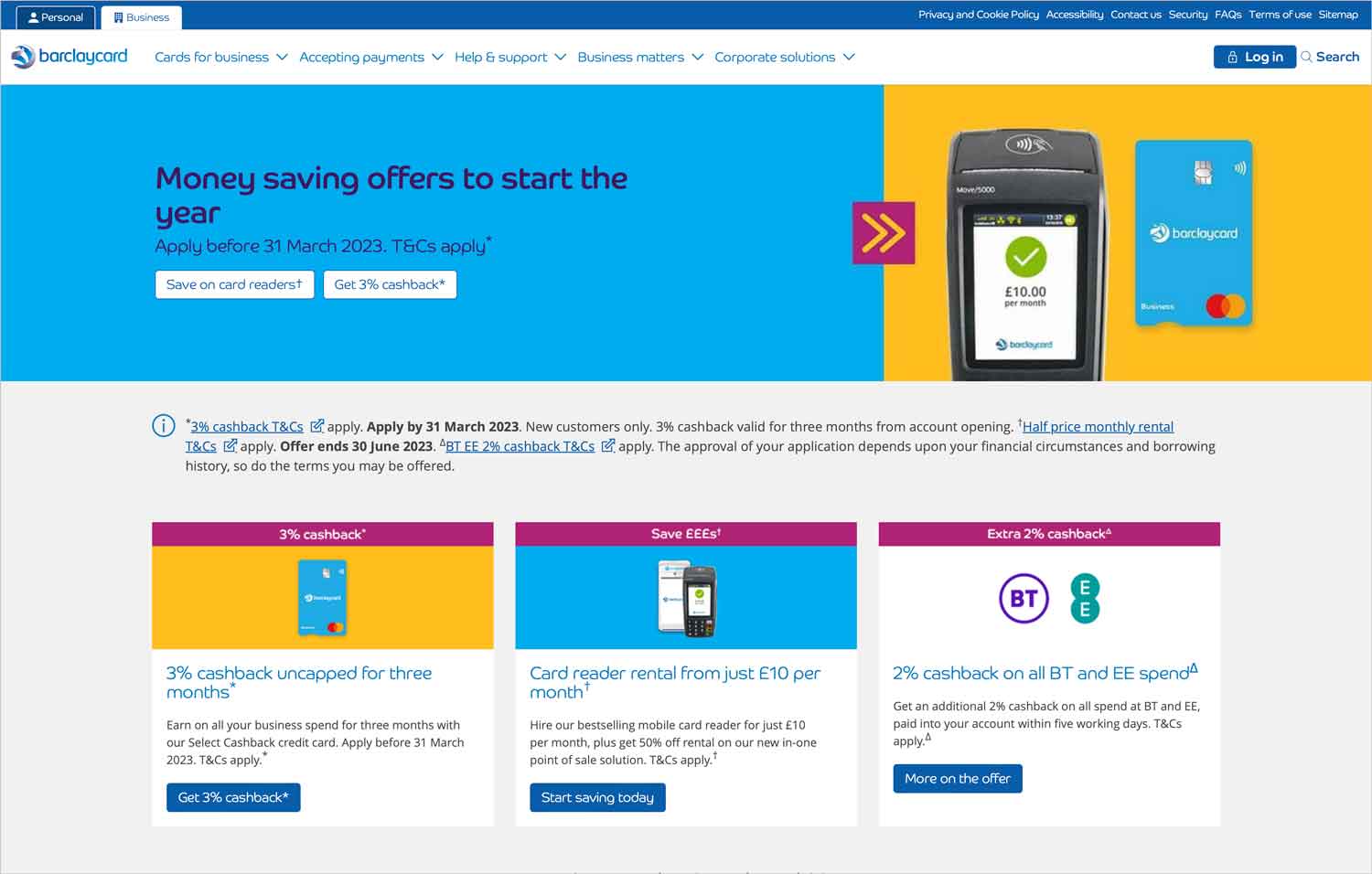

Barclaycard offers three types of card to business customers:

Select Cashback credit card

A basic MasterCard with no annual fee. This card entitles you to unlimited 1% cashback on all spending, rising to 2% if you make a transaction with EE or BT. The representative APR is 25.3%.

Premium Plus credit card

For an annual fee of £150, a representative APR of 53.9% and a variable purchase rate of 18.1%, the Premium Plus business Barclaycard offers free travel insurance, access to airport lounges across the world (two free, then a flat charge of £20,) a 2% discount on overseas transaction fees, and 0.5% cashback on all spending (capped at £400) – 2% if the purchase is through EE or BT. Ideal for frequent business travellers, this card also offers six months of interest-free purchases.

Select Charge credit card

This card is designed for everyday spending, and the balance must be paid in full every month. In exchange, Barclaycard will not charge interest on any transactions for 38 days. You will pay an annual fee of £42 for this card, and you will enjoy 2% cashback on any transactions with EE or BT.

Merchant cash advance

✗ Not available from Barclaycard. See merchant cash advance.

Business loans

✗ Not available from Barclaycard. See best business loans.

Asset finance

✗ Not available from Barclaycard. See best asset finance.

Invoice finance

✗ Not available from Barclaycard. See invoice factoring.

Commercial mortgages

✗ Not available from Barclaycard. See commercial mortgages.

Business vehicle finance

✗ Not available from Barclaycard. See business vehicle finance.

Barclaycard key information

| Phone number | 0800 008 008 |

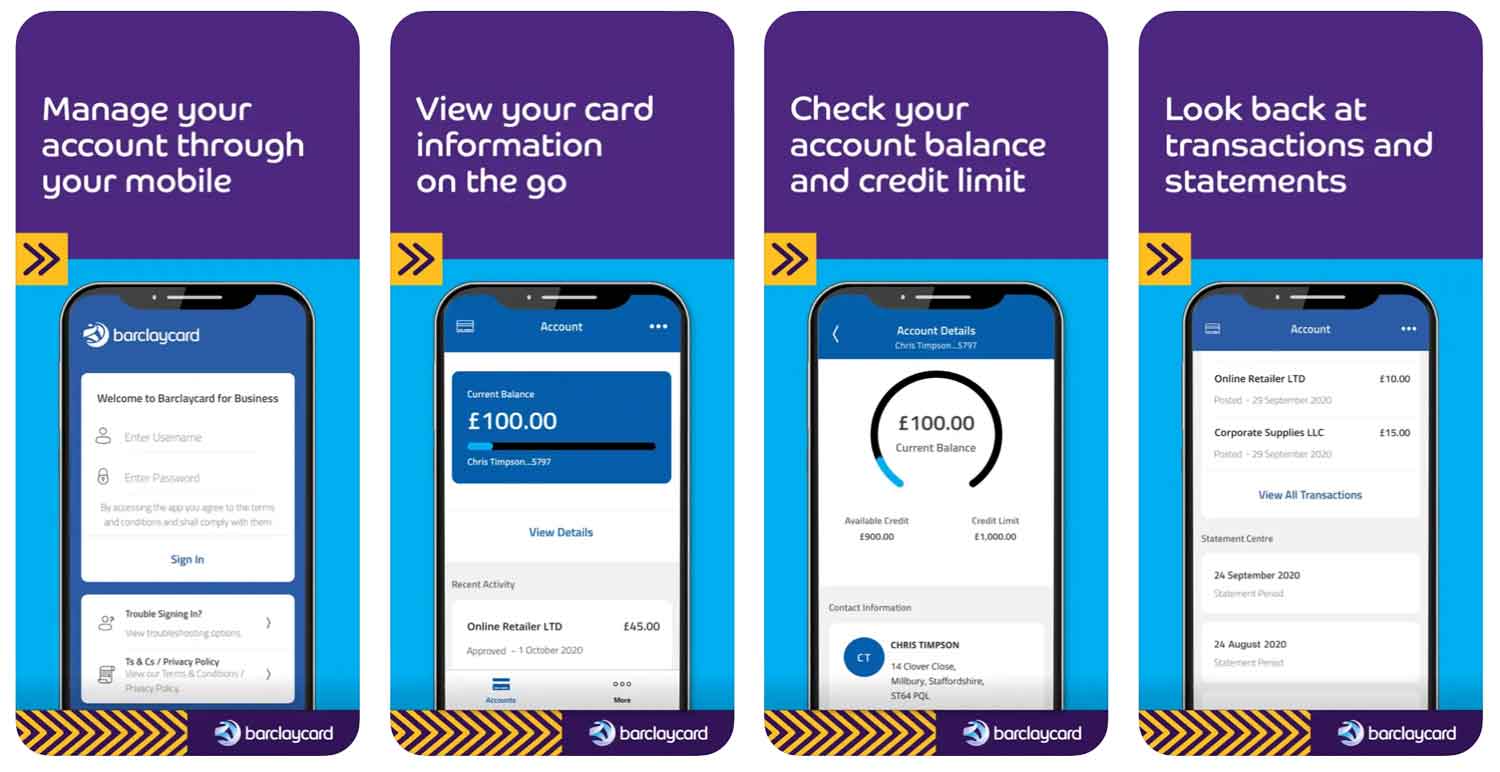

| App downloads | iOS; Android |

| Website | www.barclaycard.co.uk/business |

| Number of branches | 1,600 branches of Barclays in the UK |

| FSCS protected? | Yes |

| Founded | 1968 |

Barclaycard reviews

| Review platform | Score | Number of votes |

|---|---|---|

| TrustPilot | Not reviewed | N/A |

| Feefo | Not reviewed | N/A |

| Reviews.io | Not reviewed | N/A |

| Smart Money People | 3.42/5 | 24 |

| Which? | Not reviewed | N/A |

| Average score | 3.42/5 | 24 total votes |

Business eligibility criteria

It is not always easy to qualify for a Barclaycard business credit card. Your business will need to meet the following criteria.

- Turnover (or projected income for a start-up) over £10,000 per year

- No late or overdue payments on other lendings in the last 12 months

- No active bankruptcy proceedings or open CCJs

- Have not been declined for credit from Barclaycard in the last six months

Business finance alternatives

If Barclaycard does not meet your needs as a business credit card, or you simply wish to compare the APR and rewards with other suppliers, consider these alternative business credit and expense cards.

- American Express

- Capital on Tap

- Juni

- Soldo

Additional considerations

Barclaycard has been awarded the title of Best Business Card Provider nine times in as many years at the Business Moneyfacts Awards, and has been shortlisted for the same gong in 2023.

FAQ

No, although Barclaycard is owned by Barclays Bank, these two lending streams are considered separate entities so you can apply for a business Barclaycard if you bank elsewhere.

Applications for a Barclaycard business credit card are handled online. Head to the Barclaycard business website and fill in the form for the card that you are interested in. You could make an appointment with a branch of Barclays Bank if you prefer, but the decision criteria will be the same so this seems like a waste of time.

It’s not impossible, but it’s unlikely. Barclaycard is notoriously strict on who they issue credit cards to, so unless your business credit score is 700 or higher, your application is likely to be rejected. Consider an alternative lender if you do not want this unsuccessful application to mar your business credit report.

The minimum contracted monthly repayment on your Barclaycard business credit card will be 1% of the outstanding balance, plus any interest and account fees that have been added to your balance since your last statement. If you have a Select Charge card, you will need to settle the balance in full every month.

Yes, you can use a Barclaycard business credit card anywhere that accepts MasterCard, but any transactions not completed in £GBP will be subject to a 2.99% fee.

Using your Barclaycard card for any spending not related to your business will violate your contract. If Barclaycard believes you are using your business credit card for personal use, you may have your credit limit reduced or your account closed without warning.