ArchOver is a B2B peer lending platform that connects SMEs looking for business funding with investors that are willing to put forward the money required. This means that, once your business is approved by ArchOver to join a network of potential borrowers, you can apply for funds provided by another business, which will benefit from interest on your loan repayments. But does ArchOver have good reviews?

Be aware that any borrowing will need to be secured against your business, however, and you’ll need to submit monthly reports to ArchOver, who operate a ‘zero tolerance’ approach to missed or late payments.

Featured pro tools

Unless you want your business to go into administration, you must make your payments on time and in full, alongside the submission of monthly financial reports.

ArchOver business loans and finance

- Pros and cons

- Business loans

- Asset finance

- Business credit cards

- Invoice finance

- Merchant cash advance

- Commercial mortgages

- Business vehicle finance

- ArchOver key information

- ArchOver reviews

- Business eligibility criteria

- Business finance alternatives

- Additional considerations

- FAQ

Pros and cons of ArchOver for peer-to-peer borrowing

| Pros | Cons |

|---|---|

| ✓ Access to substantial sums – potentially up to £5,000,000 | ✗ Loans are secured against your business with very little sympathy for missed or late payments |

| ✓ Potential for lower interest rates than those offered by a direct lender | ✗ Severe penalties, including administration of your business, if you default |

| ✓ Borrowing from business peers can lead to greater flexibility than underwriters | ✗ Lengthier application and approval process than you will find with a conventional lender |

| ✓ ArchOver has good online reviews | ✗ Monthly reporting means lots of administration |

Business loans

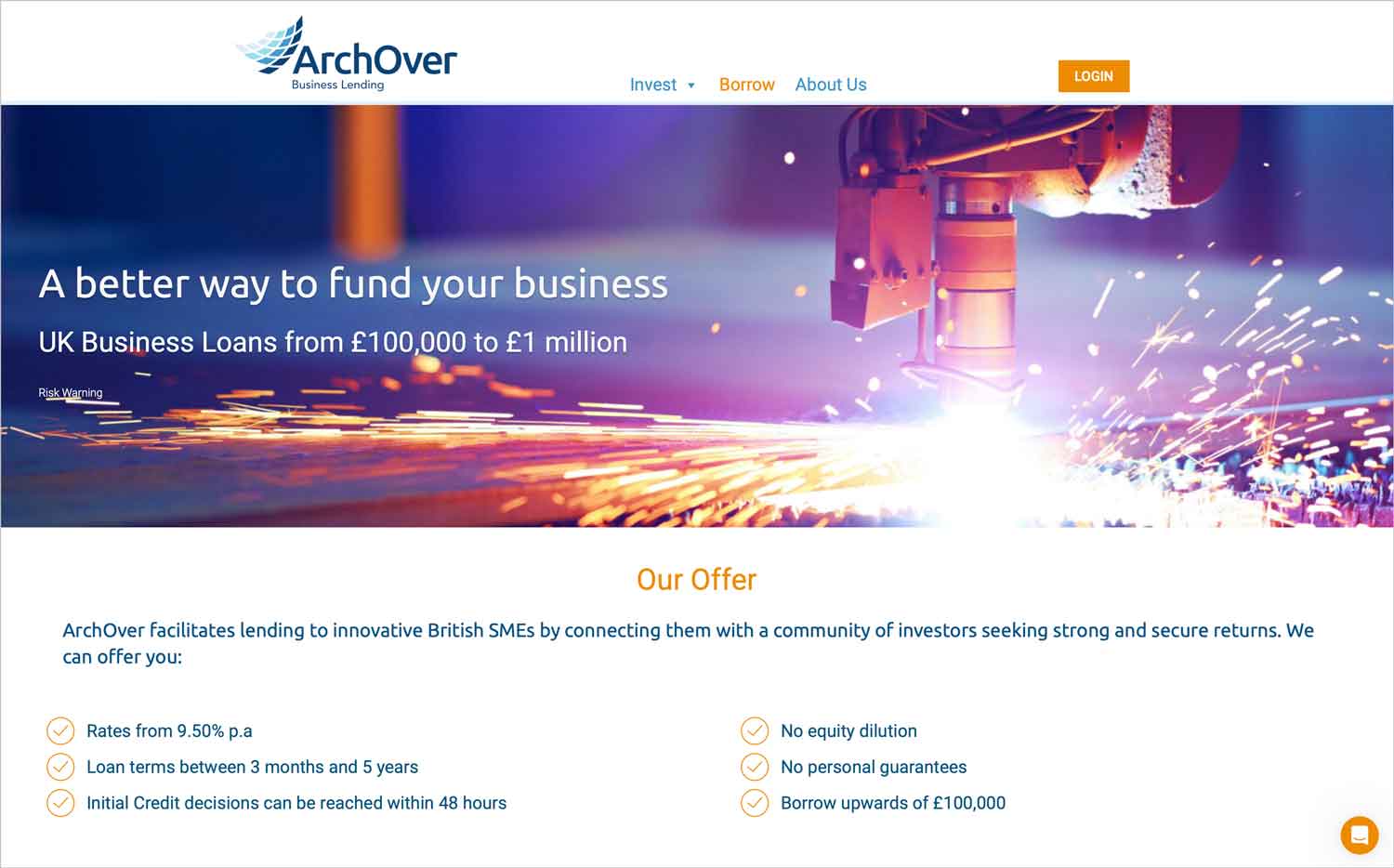

Instead of holding funds as a business asset, ArchOver lends funds provided by investors as a peer-to-peer business loan. If you are interested in applying for a lump sum loan between £100,000 and £1,000,000, get in touch with ArchOver and arrange a face-to-face meeting.

If your application is approved based on this meeting, which usually takes place within 48 hours, ArchOver will loan you funds provided by one of their investors – an interest rate will be assigned at this stage, based on the length of the repayment terms. An ArchOver business loan can be requested for any period from three months to five years.

As part of your agreement, you will need to submit monthly reports to ArchOver surrounding your business income. If you are late with this report, your account will be considered in default and action will be taken, up to and including a full administration of your business. The same applies to late or missed repayments. ArchOver operates a ‘zero tolerance’ policy with lenders to protect investors from losing money.

Asset finance

An ArchOver loan can be used to purchase assets. For more specialist lending in this arena, see best asset finance.

Business credit cards

✗ Not available from ArchOver. See business credit cards.

Invoice finance

✗ Not available from ArchOver. See invoice factoring.

Merchant cash advance

✗ Not available from ArchOver. See merchant cash advance.

Commercial mortgages

✗ Not available from ArchOver. See commercial mortgages.

Business vehicle finance

✗ Not available from ArchOver. See business vehicle finance.

ArchOver key information

| Phone number | 020 3021 8100 |

| App downloads | N/A |

| Website | www.archover.com/uk/borrow |

| Number of branches | N/A |

| FSCS protected? | No |

| Founded | 2013 |

ArchOver reviews

| Review platform | Score | Number of votes |

|---|---|---|

| TrustPilot | 3.8/5 | 86 |

| Feefo | Not reviewed | N/A |

| Reviews.io | Not reviewed | N/A |

| Smart Money People | 4/5 | 5 |

| Which? | Not reviewed | N/A |

| Average score | 3.9/5 | 91 total votes |

Business eligibility criteria

ArchOver’s sole criteria to arrange a meeting is that you must be a limited company that has been trading for at least two years. Beyond this, your eligibility – or otherwise – for borrowing will be assessed and discussed during a face-to-face meeting with ArchOver.

Business finance alternatives

As ArchOver offers a somewhat complex lending model, you may prefer to apply for funding through a high street bank that holds cash reserves rather than peer-to-peer lending.

Additional considerations

ArchOver announced in January that it is exiting the retail peer-to-peer lending market, but remaining open for business, especially with larger loans in excess of £750,000. Call ArchOver to discuss your options if you remain interested in borrowing from this company.

FAQ

All lending from ArchOver begins with a phone call. Call this business on 020 3021 8100 to learn if you will be eligible to borrow funds.

ArchOver loans are typically available for between £10,000 and £1,000,000.

Once you apply for funding with ArchOver, you will need to arrange a face-to-face meeting that assesses the finances or your business and your lending needs. If this meeting has a successful outcome, you will typically receive funding within 48 hours.

This depends on the interest rate that you are assigned. Business loans from ArchOver start at an APR of 9.5%, which can be lower than you will find through some traditional lenders.

If you agree to a loan from ArchOver your borrowing will automatically be secured against your business. To this end, you will be required to submit monthly financial reports that demonstrate the financial health of your company.

ArchOver promises investors a ‘zero tolerance’ approach to defaults on borrowing for their protection. This means that any failure to make a payment within 14 days of a due date, or even a likelihood that you may breach due to poor financial performance on a previous monthly report, can result in ArchOver appointing an administrator and assigning them to your business.