As a business owner, understanding your company’s credit report is vital to your financial health. Credit reports provide a detailed overview of your business’s creditworthiness, and lenders and suppliers use this information to make decisions about whether to extend credit or offer terms of payment.

In this article, we will explain what business credit reports are, how they are used, and how you can access and improve your credit report.

Featured pro tools

- What is a business credit report?

- What does a business credit report look like?

- How are business credit reports used?

- How to access your business credit report?

- How to improve your business credit report?

- FAQ

What is a business credit report?

A business credit report is a summary of your company’s credit history. It includes information on your creditworthiness, payment history, and financial stability. Credit bureaus collect and compile this data from various sources, including public records, credit applications, and trade references.

Credit reports typically contain several sections, including:

- Company information: This section includes your company’s name, address, and contact information.

- Credit history: This section includes information on your company’s credit accounts, such as credit cards, loans, and lines of credit. It also includes information on how you have managed these accounts, such as your payment history and any late or missed payments.

- Public records: This section includes information on bankruptcies, liens, judgments, and other legal actions that may impact your creditworthiness.

- Payment trends: This section includes information on how your payment habits compare to other businesses in your industry.

- Credit score: This is a numerical representation of your creditworthiness based on the information in your credit report. Read our guide to checking business credit scores.

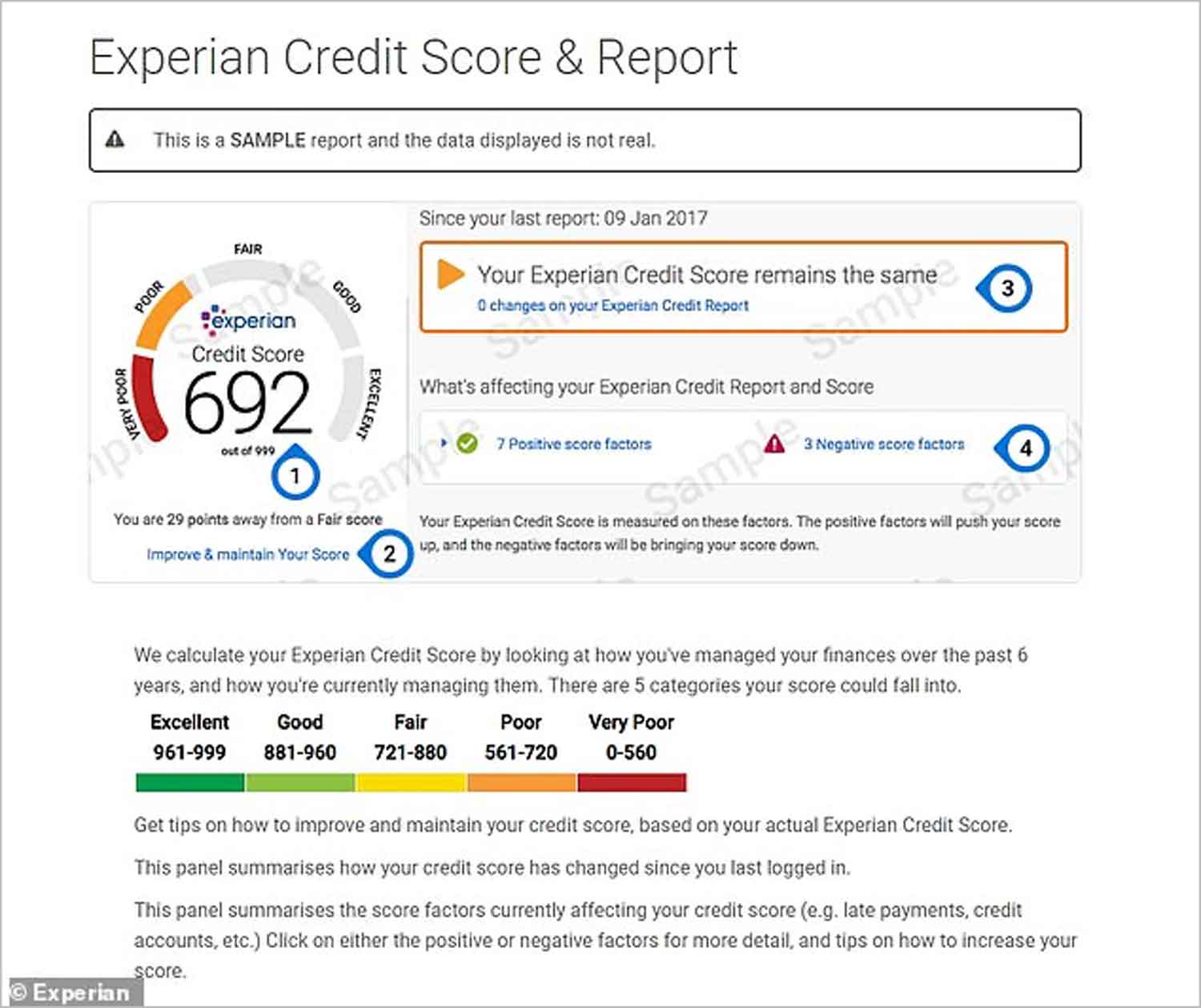

What does a business credit report look like?

How are business credit reports used?

Business credit reports are used by lenders, suppliers, and other creditors to evaluate your company’s creditworthiness. They use this information to make decisions about whether to extend credit, offer terms of payment, or enter into other financial transactions with your business.

Your credit report can also be used by insurance companies, landlords, and potential business partners to evaluate your company’s financial stability and reliability.

How to access your business credit report?

In the UK, there are several credit bureaus that provide business credit reports. The main credit bureaus are Experian, Equifax, and TransUnion. You can access your credit report from any of these bureaus, and you are usually entitled to one free credit report per year.

To access your credit report, you will need to provide some basic information about your company, such as your company name, address, and registration number. You may also be required to provide identification and other documentation to verify your identity.

How to improve your business credit report?

Improving your business credit report is essential for securing favourable terms on business loans, lines of credit, and other financial transactions. Here are some tips for improving your business credit report:

- Pay your bills on time: Late or missed payments can have a significant impact on your credit score. Make sure you pay your bills on time, every time.

- Monitor your credit report: Regularly review your credit report for inaccuracies and errors. If you find any errors, dispute them with the credit bureau.

- Manage tour credit utilisation: Keep your credit utilisation low by only using a small percentage of your available credit.

- Maintain a positive payment history: Consistently making on-time payments and paying off debt can help improve your credit score over time.

- Build strong relationships with suppliers and vendors: Establishing good relationships with your suppliers and vendors can help you build a positive credit history and improve your creditworthiness.

In conclusion, understanding your business credit report is essential for maintaining financial stability and securing favourable terms on loans and other financial transactions. By regularly monitoring your credit report and taking steps to improve your creditworthiness, you can ensure your business is in a strong financial position for years to come.

FAQ

A business credit report is a summary of your company’s credit history, including information on your creditworthiness, payment history, and financial stability.

A business credit report is important because lenders, suppliers, and other creditors use this information to evaluate your company’s creditworthiness and make decisions about whether to extend credit, offer terms of payment, or enter into other financial transactions with your business.

You can get a copy of your business credit report from any of the main credit bureaus in the UK, including Experian, Equifax, and TransUnion. You are entitled to one free credit report per year.

It’s a good idea to check your business credit report at least once a year, and more frequently if you are actively seeking financing or credit.

A business credit report typically includes information on your company’s credit accounts, payment history, public records, payment trends, and credit score.

A credit score is a numerical representation of your creditworthiness based on the information in your credit report.

Credit scores are calculated using a variety of factors, including your payment history, credit utilisation, length of credit history, and types of credit used.

Credit scores for businesses typically range from 0 to 100, with higher scores indicating better creditworthiness. A score of 80 or above is generally considered good.

Negative information, such as late or missed payments, bankruptcies, and liens, can stay on your credit report for up to seven years.

Yes, if you find errors on your credit report, you can dispute them with the credit bureau.

The time it takes to correct errors on your credit report can vary, but credit bureaus typically have 30 days to investigate and respond to your dispute.

Improving your business credit score involves paying your bills on time, managing your credit utilisation, maintaining a positive payment history, and building strong relationships with suppliers and vendors.

Improving your business credit score can take time, but consistent on-time payments, paying off debt, and building strong relationships with suppliers and vendors can help improve your creditworthiness over time.

A trade reference is a credit reference provided by a supplier or vendor that you have done business with.

Positive trade references can help improve your credit score by demonstrating a positive payment history and strong relationships with suppliers and vendors.

Establishing credit for a new business can be challenging, but it can be done by opening a business credit card, applying for a small business loan, or using trade credit from suppliers.

It may be more difficult to get a loan for your business if you have bad credit, but you may have options. Learn more here.