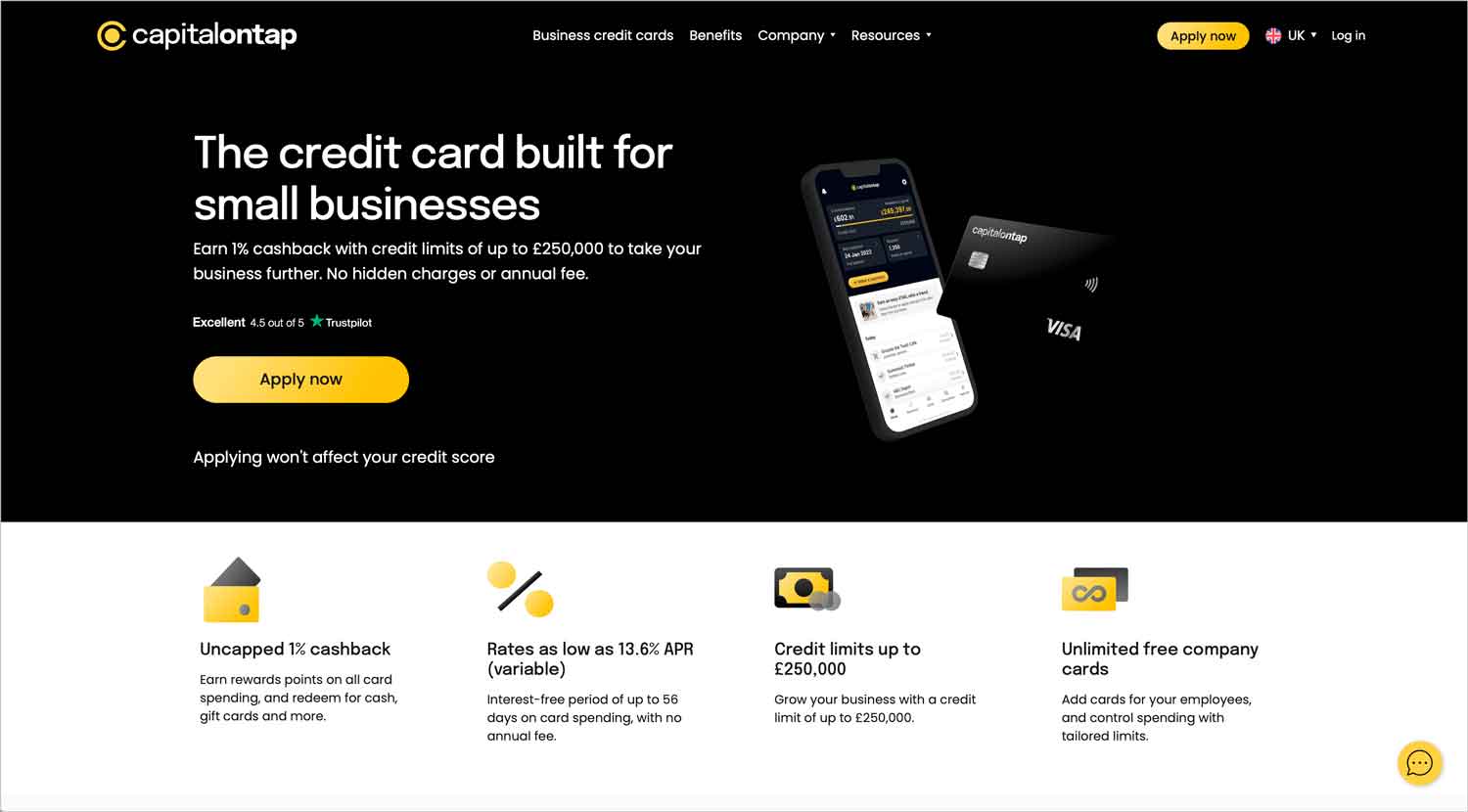

Capital on Tap is a business credit card designed for SMEs – but does it have good reviews? Issued by Visa, and available as a physical card as well as being compatible with Google and Apple Pay, a Capital on Tap credit card comes with a range of benefits to customers, most notably uncapped cashback of 1% of all spending and a points reward system.

Capital on Tap is available to any business listed on Companies House with a monthly turnover of £2,000 or more, making this a flexible and accessible approach to business credit.

Featured pro tools

Capital on Tap business credit cards

- Pros and cons

- Business credit cards

- Merchant cash advance

- Business loans

- Asset finance

- Invoice finance

- Commercial mortgages

- Business vehicle finance

- Capital on Tap key information

- Capital on Tap reviews

- Business eligibility criteria

- Business finance alternatives

- Additional considerations

- FAQ

Pros and cons of Capital on Tap credit cards

| Pros | Cons |

|---|---|

| ✓ Credit limit of up to £250,000 | ✗ Not available to sole traders |

| ✓ 1% cashback on all purchases | ✗ Some users complain about the APR |

| ✓ No fees for currency transfers or ATM withdrawals | |

| ✓ Very good online reviews on TrustPilot |

Business credit cards

The Capital on Tap business credit card is a Visa card. You will attract enjoy 1% cashback on all purchases and earn points that can be exchanged for cash or discounts on your balance. Capital on Tap cardholders are also entitled to discounts with a range of vendors when using their card, including Microsoft, Hertz, and Zoom.

Regular business travellers may wish to apply for a Business Rewards account. This will cost £99 per year, but your Capital on Tap account will automatically be awarded 10,000 points if you spend £5,000 in the first three months of use, and your points can be redeemed with Avios for flights, hotels, and car hire.

The maximum credit limit on a Capital on Tap credit card is £250,000, though obviously there are no guarantees that you will be provided with this much leeway upon application. Your credit limit be assigned upon a successful application. The average APR is 13.6%, with up to 56 days being interest-free.

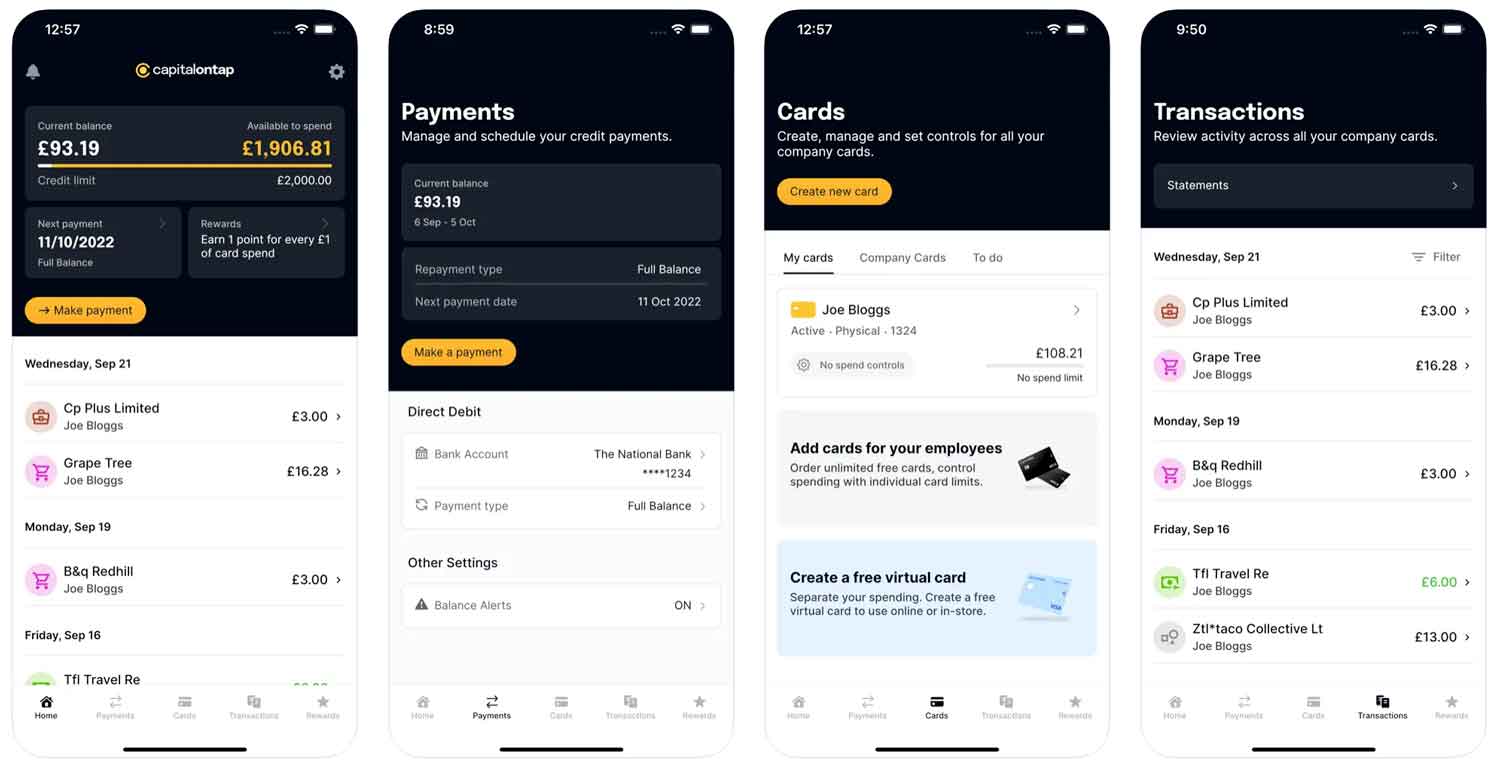

While Capital on Tap will send you a physical, plastic card, you can also add your Capital on Tap card to your Apple Pay or Google Pay wallet. This electronic card will be available as soon as your account is approved. You can manage your Capital on Tap account online or through the app, integrating the card with third-party accounting software if you wish.

Merchant cash advance

✗ Not available from Capital on Tap. See merchant cash advance.

Business loans

✗ Not available from Capital on Tap. See best business loans.

Asset finance

✗ Not available from Capital on Tap. See best asset finance.

Invoice finance

✗ Not available from Capital on Tap. See invoice factoring.

Commercial mortgages

✗ Not available from Capital on Tap. See commercial mortgages.

Business vehicle finance

✗ Not available from Capital on Tap. See business vehicle finance.

Capital on Tap key information

| Phone number | 020 8962 7401 |

| App downloads | iOS; Android |

| Website | www.capitalontap.com |

| Number of branches | N/A – Capital on Tap is an online business |

| FSCS protected? | No |

| Founded | 2012 |

Capital on Tap reviews

| Review platform | Score | Number of votes |

|---|---|---|

| TrustPilot | 4.5/5 | 10,618 |

| Feefo | Not reviewed | N/A |

| Reviews.io | Not reviewed | N/A |

| Smart Money People | 5/5 | 2 |

| Which? | Not reviewed | N/A |

| Average score | 4.75/5 | 10,620 total votes |

Business eligibility criteria

To qualify for a Capital on Tap credit card, you must meet the following criteria:

- Be a limited company or partnership based in the UK and listed on Companies House

- Have a monthly business turnover of at least £2,000

- Have no unsatisfied CCJs against your business name in the last year

Business finance alternatives

If Capital on Tap does not meet your needs as a business credit card, or you simply wish to compare the APR and rewards with other suppliers, consider these alternative business credit and expense cards.

- American Express

- Barclaycard

- Juni

- Soldo

Additional considerations

While Capital on Tap currently only offers credit cards the business clearly has eyes on expanding into further lending, recently securing nine figures of funding to build a central hub designed to assist small businesses.

FAQ

Capital on Tap has a very simple online application form that only takes a couple of minutes to complete. Head to the website and provide your company details.

Most applications for a Capital on Tap credit card and reviewed within minutes, based on a soft credit search. If your application is successful you will be offered an APR and interest rate, and if you accept these terms, a final credit check will be completed and the card issued. You can use a digital card with Apple Pay or Google Pay while you wait for your physical card to arrive.

A credit limit will be assigned based on your business finances and turnover. The maximum credit limit offered by Capital on Tap is £250,000. Your credit limit will be reviewed periodically and potentially increased or reduced in line with your use.

The minimum contracted monthly repayment on your Capital on Tap business credit card will be 10% of the outstanding balance, though the more you clear, the less interest you will accrue.

Yes, you can use a Capital on Tap business credit card anywhere that accepts Visa credit cards.

Using your Capital on Tap card for any spending not related to your business will violate your contract. If Capital on Tap believes you are using your business credit card for personal use, you may have your credit limit reduced or your account closed without warning.