Compound interest has the power to give your savings a boost and can help you get on top of debt quicker. To make understanding compound interest easier, we created an interactive compound interest calculator – so you can quickly see how different rates and saving lengths can affect the outcome of your savings or loan payments.

What is compound interest?

Compound interest is a type of interest calculated on the initial principal and also on the accumulated interest from previous periods. This is different from simple interest, which is only calculated on the original principal amount. Compounding can occur quarterly, annually, or at other periodic intervals.

Featured pro tools

Understanding compound interest on loans

Compound interest is used for mortgages, car loans, business loans and other types of borrowing. It’s important to understand how it works so you can make the most informed decision when taking out a loan.

When you take out a loan with compound interest, your monthly payments will include some of the principal amount borrowed and some of the interest accrued over time. As you make your payments, the principal portion of the payment will reduce while the interest portion increases in size. This means that each payment includes more and more interest as you get closer to paying off the loan.

How to calculate compound interest

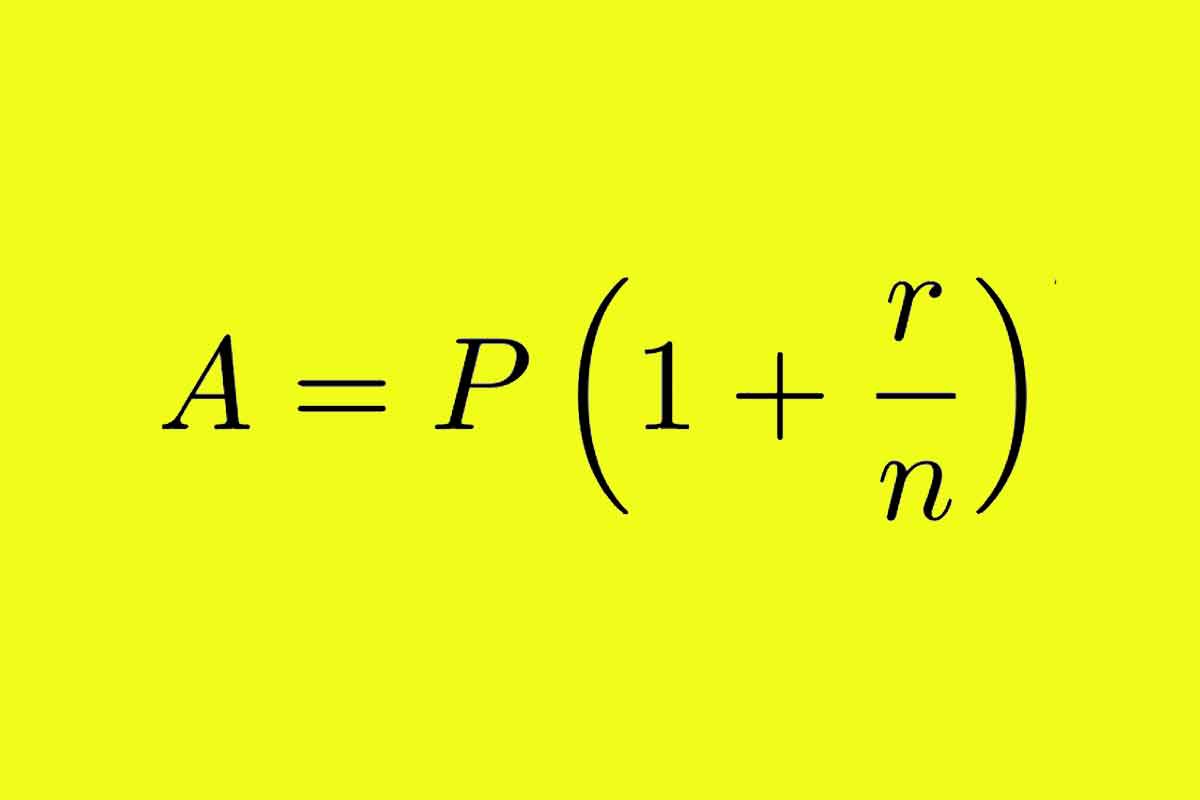

The formula to calculate compound interest is:

A = P(1 + r/n)nt

Where:

| A | Accrued amount (principal + interest) |

| P | Principal amount |

| r | Annual nominal interest rate as a decimal |

| n | Number of compounding periods per unit of time |

| t | Time in decimal years; e.g., 6 months is calculated as 0.5 years. Divide your partial year number of months by 12 to get the decimal years |