As the name suggests, the Cumberland Building Society is a financial institution located in Cumbria, intended for use by local businesses.

If geography allows you to take advantage of the services provided by this financial body, you’ll potentially enjoy some impressive rates on business savings, though this is tempered by limited and slightly fiddly current account processes.

Featured pro tools

The catchment area is strict, so check that you qualify for the perks of a Cumberland Building Society account before giving this facility any serious consideration.

Cumberland Building Society business banking services

- Pros and cons

- Business current accounts

- Business overdrafts

- Business savings accounts

- Cumberland Building Society at a glance

- Cumberland Building Society business loans and finance

- The Cumberland Building Society reviews

- Business eligibility criteria

- Business finance alternatives

- Additional considerations

- FAQ

Pros and cons of Cumberland Building Society for business services

| Pros of Cumberland Building Society | Cons of Cumberland Building Society |

|---|---|

| ✓ Two different current accounts | ✗ Limited current account options |

| ✓ Good interest rate on instant access savings | ✗ Branches only in Cumberland |

| ✓ FSCS protected | ✗ You must be located in a catchment area to open an account |

Business current accounts

The Cumberland Building Society offers two business bank accounts. You will be asked to provide information about your business model, and the Cumberland Building Society will assign the account considered most suitable for your needs.

Both attract a monthly fee, but one account offers free electronic transactions in exchange for lower credit interest, while the other pays more interest on your balance but charges more for transactions. The former option will likely be recommended to account holders that primarily deal with automated transactions, while the latter will be offered to anybody that needs to deposit substantial sums in cash or cheque form.

Business overdrafts

✗ Not available through the Cumberland Building Society. See best business overdrafts.

Business savings accounts

The Cumberland Building Society offers three business savings accounts:

Instant Access account

Save a minimum of £100 and access your money at any time, with a maximum daily withdrawal of £500. Interest is calculated daily and paid annually at the end of the financial year at an AER of 2.40%.

eSavings account

Exclusively for holders of a Cumberland Building Society business current account, this account has a minimum balance of just £1 and a maximum of £1,000,000. You can access your account at any time, while interest is calculated daily and paid annually at the end of the financial year at an AER of 2.60%.

40 Day Notice account

This account has a minimum balance of £10,000,000 and a maximum of £1,000,000. You can access your account with 40 days’ notice, while interest is calculated daily and paid annually at the end of the financial year at an AER of 2.60%.

Cumberland Building Society at a glance

| Phone number | 01228 403141 |

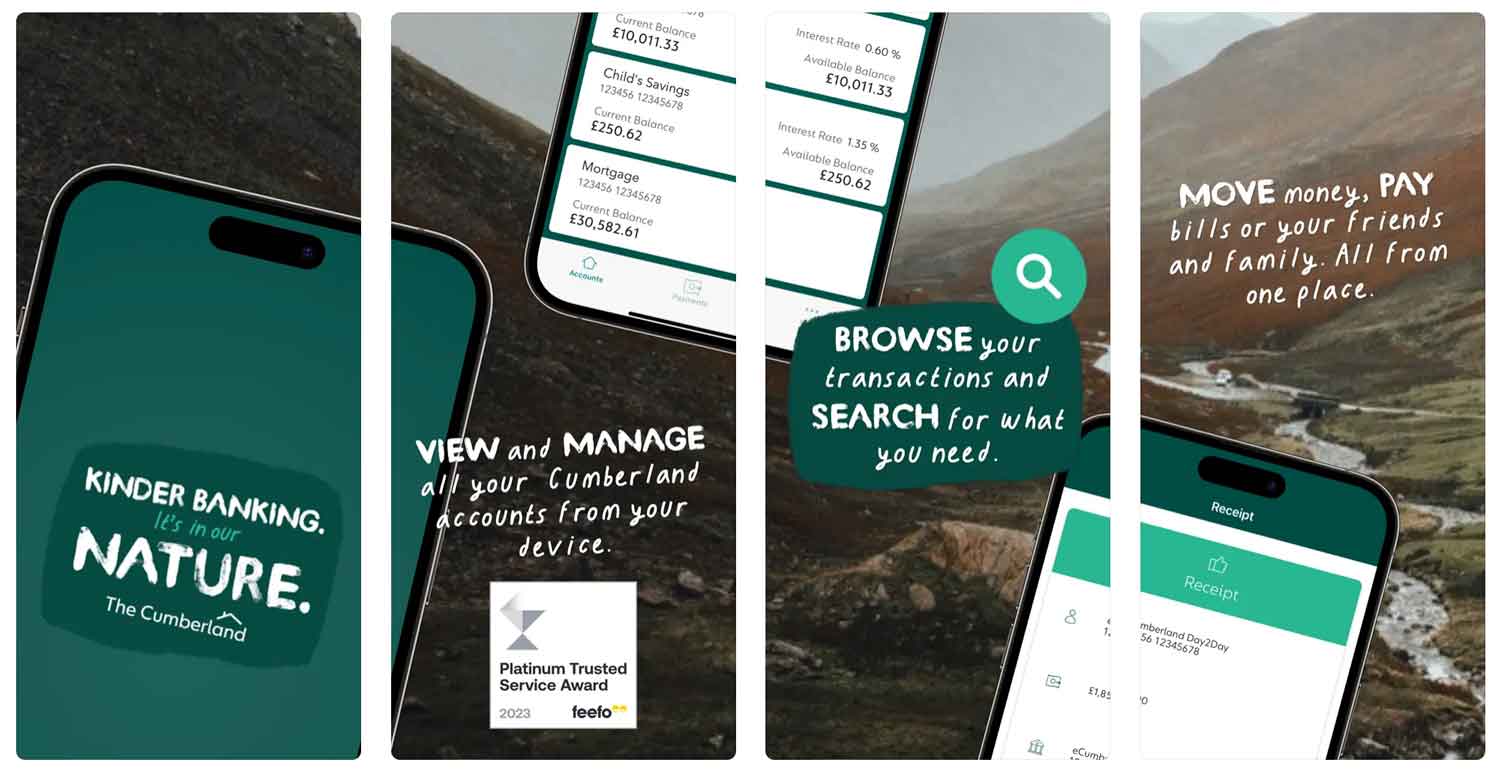

| App downloads | iOS; Android |

| Website | www.cumberland.co.uk/business |

| Number of branches | 34, all in Cumberland and the surrounding area |

| FSCS protected? | Yes |

| Founded | 1850, Carlisle |

Cumberland Building Society business loans and finance

The Cumberland Building Society also provides business mortgages, but only for B&Bs, holiday lets, and buy-to-let property portfolio purchases in the Cumberland area.

The Cumberland Building Society reviews

What are other business banking customers saying about The Cumberland Building Society?

| Review platform | Score | Number of votes |

|---|---|---|

| TrustPilot | 2.2/5 | 26 |

| Feefo | 4.8/5 | 1,799 |

| Reviews.co.uk | Not reviewed | N/A |

| Smart Money People | 4.85/5 | 101 |

| Which? | Not reviewed | N/A |

| Average score | 3.95/5 | 1,926 |

Business eligibility criteria

Cumberland Building Society accounts can be opened online or over the telephone, so you do not need to visit a local branch to open an account, but you must have a business address within the building society’s catchment area. This building society will decline your application unless your postcode begins with CA, LA, DG, TD9, NE45-49, FY, BB1-2, or BB5-7.

Business finance alternatives

As the Cumberland Building Society is only available to people in the catchment area, anybody based in the Midlands or South of England, Wales, or Northern Ireland may want to consider Nationwide Building Society as a national alternative.

Additional considerations

While the Cumberland Building Society is a local service it enjoys international recognition, having recently received awards from industry bodies as far-flung as Miami, Florida.

FAQ

No, Cumberland Building Society is a building society rather than a bank. It is authorised and regulated by the Financial Conduct Authority (FCA) and Prudential Regulation Authority (PRA). This means that it complies with all applicable laws and regulations in the UK regarding banking services.

In order to open a business account at Cumberland Building Society you will need to fill in an application form. You may also need to provide proof of identity, such as a passport or driving license, along with proof of address, such as a utility bill or bank statement. It is important that the information supplied on the application form is accurate and up to date. Once the application is approved, you will receive your account details and can begin using your new Cumberland Building Society business account.

Cumberland Building Society charges a fee for using its services, including overdrafts, loans and international transfers. The exact fees depend on the type of service you are using and may vary from time to time. It is important to check with Cumberland Building Society directly for up-to-date information about their current fees.

Cumberland Building Society offers a wide range of services for businesses, including business current accounts, savings accounts and loans. They also offer services such as online banking, telephone banking and international transfers. You can find full details of the services offered by Cumberland Building Society on their website.

Cumberland Building Society accepts a variety of payment methods, including debit cards, credit cards, direct debits and standing orders. They also accept payments by cheque and cash at certain branches.