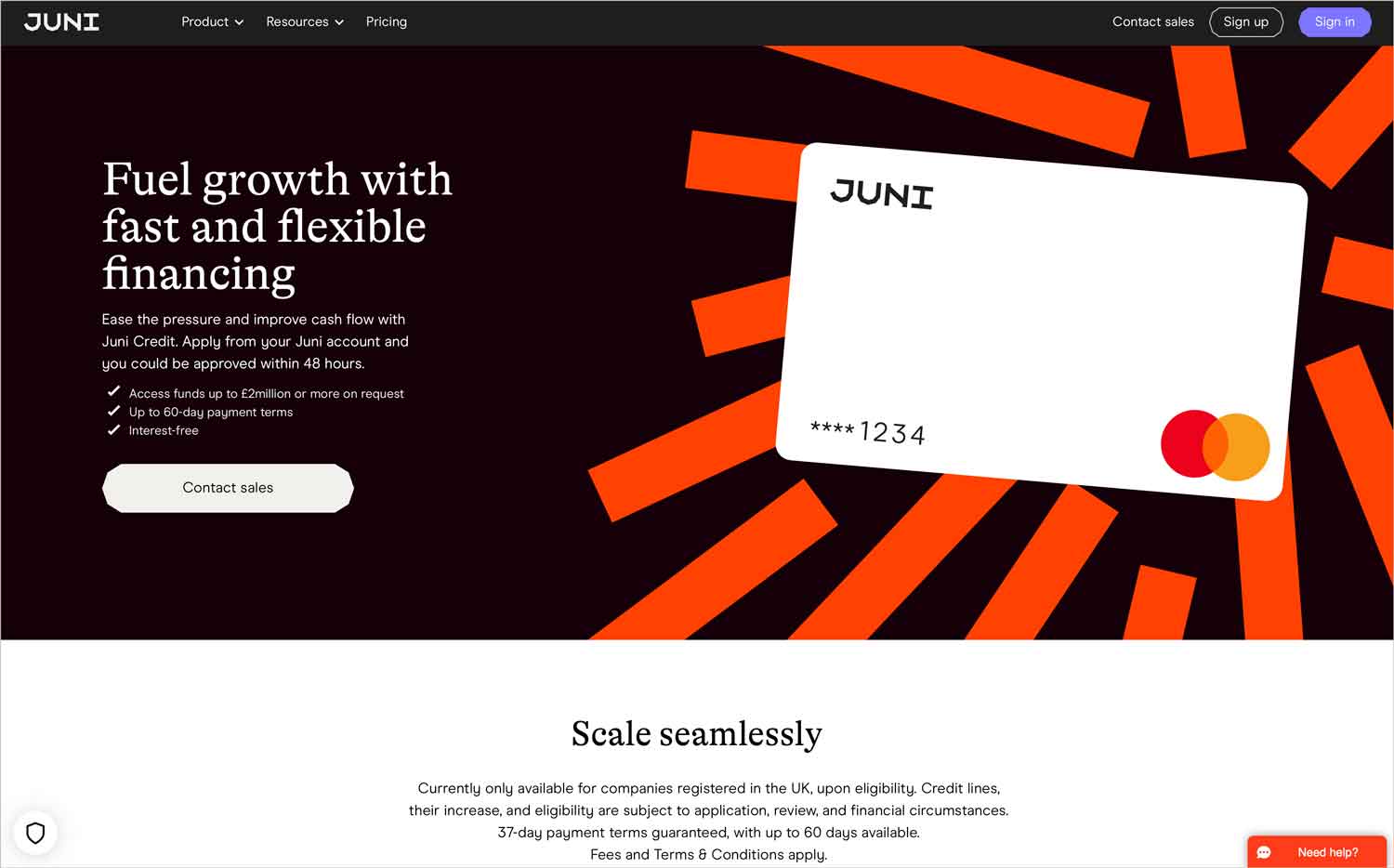

Juni is a financial platform built with eCommerce websites in mind. Juni subscribers can sign up for free and integrate all manner of financial data into one dashboard, while also opening a bank account to hold funds in multiple currencies. This account comes with a free MasterCard charge card that can be pre-loaded with funds.

Juni customers can also apply for a credit card, which can be loaded with a credit line between £10,000 and £2,000,000.

Featured pro tools

The snag is that, while this is a MasterCard, it is exclusively intended for an eCommerce business looking for a line of credit to spend on online advertising. This means that a business seeking a card for general spending will likely see its application declined.

Juni business credit card

- Pros and cons

- Business credit cards

- Merchant cash advance

- Business loans

- Asset finance

- Invoice finance

- Commercial mortgages

- Business vehicle finance

- Juni key information

- Juni reviews

- Business eligibility criteria

- Business finance alternatives

- Additional considerations

- FAQ

Pros and cons of Juni for business credit cards

| Pros | Cons |

|---|---|

| ✓ Credit limit of up to £2,000,000 | ✗ Designed for online advertising costs for eCommerce sites, not general spending |

| ✓ Cashback offered on spending | ✗ Payment terms capped at 60 days |

| ✓ No annual fees or associated expenses | ✗ Must sign up for a Juni account to apply |

| ✓ Easy to manage and monitor spending through the Juni dashboard | ✗ Not available to sole traders |

| ✓ Good online reviews on TrustPilot | ✗ Limited customer service – no phone support, for example |

| ✗ Lack of transparency in interest rates and credit limit ahead of application | |

| ✗ No apps – card must be managed on a desktop computer |

Business credit cards

If you open a Juni account, you will have access to a charge card that can be pre-loaded with funds. Any spending made on this card will attract 1% cashback. Once you have an account, you can also apply for a Juni credit card.

Now, we need to be at pains to repeat what we have already said here. A Juni credit card is not a typical MasterCard designed for general spending. It is a line of credit, repayable in 37 or 60 days, designed to be spent exclusively on online advertising by eCommerce businesses. If Juni suspects that your application will not relate to this spending model, your application for a line of credit will more than likely be declined.

If your application for a Juni credit card is successful, you will be provided with a virtual and physical MasterCard. The credit limit on this card may eventually reach £2,000,000 over time, and will not attract any annual fees.

Merchant cash advance

✗ Not available from Juni. See merchant cash advance.

Business loans

✗ Not available from Juni. See best business loans.

Asset finance

✗ Not available from Juni. See best asset finance.

Invoice finance

✗ Not available from Juni. See invoice factoring.

Commercial mortgages

✗ Not available from Juni. See commercial mortgages.

Business vehicle finance

✗ Not available from Juni. See business vehicle finance.

Juni key information

| Phone number | N/A – email and live chat support only |

| App downloads | N/A – web-based account management only |

| Website | www.juni.co/credit-business-card |

| Number of branches | N/A – Juni is an online business |

| FSCS protected? | No |

| Founded | 2020, Gothenburg |

Juni reviews

| Review platform | Score | Number of votes |

|---|---|---|

| TrustPilot | 4.4/5 | 328 |

| Feefo | Not reviewed | N/A |

| Reviews.io | Not reviewed | N/A |

| Smart Money People | Not reviewed | N/A |

| Which? | Not reviewed | N/A |

| Average score | 4.4/5 | 328 total votes |

Business eligibility criteria

To qualify for a Juni credit card, you must meet the following criteria:

- Have an open Juni account

- Be an eCommerce limited company or partnership based in the UK and listed on Companies House

- Have been trading for at least three months

- Be willing and able to provide open banking sources to all financial accounts in your business name

Business finance alternatives

As Juni’s credit card is a very specialist product, it may not meet your needs. Consider these alternative business credit and expense cards.

- American Express

- Barclaycard

- Capital on Tap

- Soldo

Additional considerations

Juni acquired a great deal of funding in 2022 to expand their offering to SMEs, but the business is clearly in a state of flux – a third of staff was made redundant in a reshuffle in late 2022. While this happens in the corporate world, it could point to a measure of instability for risk-averse business customers.

FAQ

If you are interested in working with Juni, sign up for a free account – this is the first step to gaining access to a line of credit. Once you have a Juni account, you will gain access to the credit section of the website and make an online application.

It takes Juni around 48 hours to review your eligibility and come back with an answer as to whether you have been accepted for a credit card. You will need to link Juni to all of your financial partners through open banking. Once approved, you will have immediate access to your credit through a virtual card.

A credit limit will be assigned based on your business finances and turnover. Juni offers lines of credit starting at £10,000 and up to £2,000,000, though you are unlikely to be offered this much at first. Juni regularly reviews credit limits and increases or decreases as considered necessary.

While a Juni credit card is a MasterCard and thus universal, it will be issued upon the expectation that you will use the card to pay for online advertising. If Juni notices transactions with vendors other than the likes of Google, Facebook, TikTok, and LinkedIn, they may ask for an explanation or cancel your line of credit.

A Juni credit card cannot hold and roll over a balance from month to month. You will be assigned payment terms of 37 or 60 days, and expected to clear your balance within these parameters.

In theory, Juni will assign up to 1% of cashback on any transaction made using a credit card. This will be confirmed upon application.