Metro Bank is one of the newer banks on the high street, and while it may not yet enjoy the reputation and brand recognition of the “Big Four,” it has steadily built a reliable reputation as a business-friendly bank with a dedication to customer service.

This bank is particularly helpful to a larger business, as the commercial account (reserved for turnover above £2,000,000 PA) attracts no fees, but as this provider also offers a range of competitively-priced lending streams, most sole traders or SMEs will consider Metro Bank worthy of consideration.

Featured pro tools

Metro Bank business banking services

- Pros and cons

- Metro business current accounts

- Metro business overdrafts

- Metro business savings accounts

- Metro Bank at a glance

- Other business finance products

- Metro Bank reviews

- Business eligibility criteria

- Business finance alternatives

- Additional considerations

- FAQ

Pros and cons of Metro Bank for business services

| Pros of Metro Bank | Cons of Metro Bank |

|---|---|

| ✓ Excellent reputation for customer service | ✗ 30p fee applies to most transactions |

| ✓ Competetive interest on lending | ✗ No branches in Scotland or Nothern Ireland |

| ✓ FSCS protected | ✗ Only two branches in Wales – both in Cardiff |

Business current accounts

Metro Bank offers three business bank accounts:

Business Bank Account

This account is for sole traders and SMEs with an annual turnover below £2,000,000 per year. The account attracts a monthly fee of £6, but if your balance remains above £6,000 for an entire calendar month this will be waived by Metro Bank.

If your balance remains above £6,000,000, you will also be entitled to 30 free transactions per month. If your balance drops below this minimum, or you have used up your 30 free transactions, you will be charged 30p for every transaction you make from the account. That means every payment made or received, every debit card purchase, and every ATM withdrawal.

Commercial Current Account

This account is exclusively for businesses with an annual turnover that exceeds £2,000,000 per year. There are no fees attached to this account, and you will be assigned a dedicated Relationship Manager by Metro Bank.

Foreign Currency Account

Open an account in one of 14 overseas currencies if you complete significant trade with overseas clients and customers.

Business overdrafts

Metro Bank offers a business overdraft between £100 and £60,000. Representative EAR is 14.42%, and a setup fee of 1.75% of your total overdraft limited will be charged. See our guide to business overdrafts.

Business savings accounts

Metro Bank offers two savings accounts to business customers:

Business Instant Access Deposit Account

Instant access to your savings at any time, with your money earning interest at an AER rate of 0.70%. No monthly fees are payable to maintain this savings account, and there is no minimum balance.

Business Fixed Term Deposit Account

Deposit a minimum of £5,000 and attract a fixed term interest rate of 3.01% (one year) or 3.06% (two years) upon maturation.

Metro Bank at a glance

| Phone number | 0345 080 8500 |

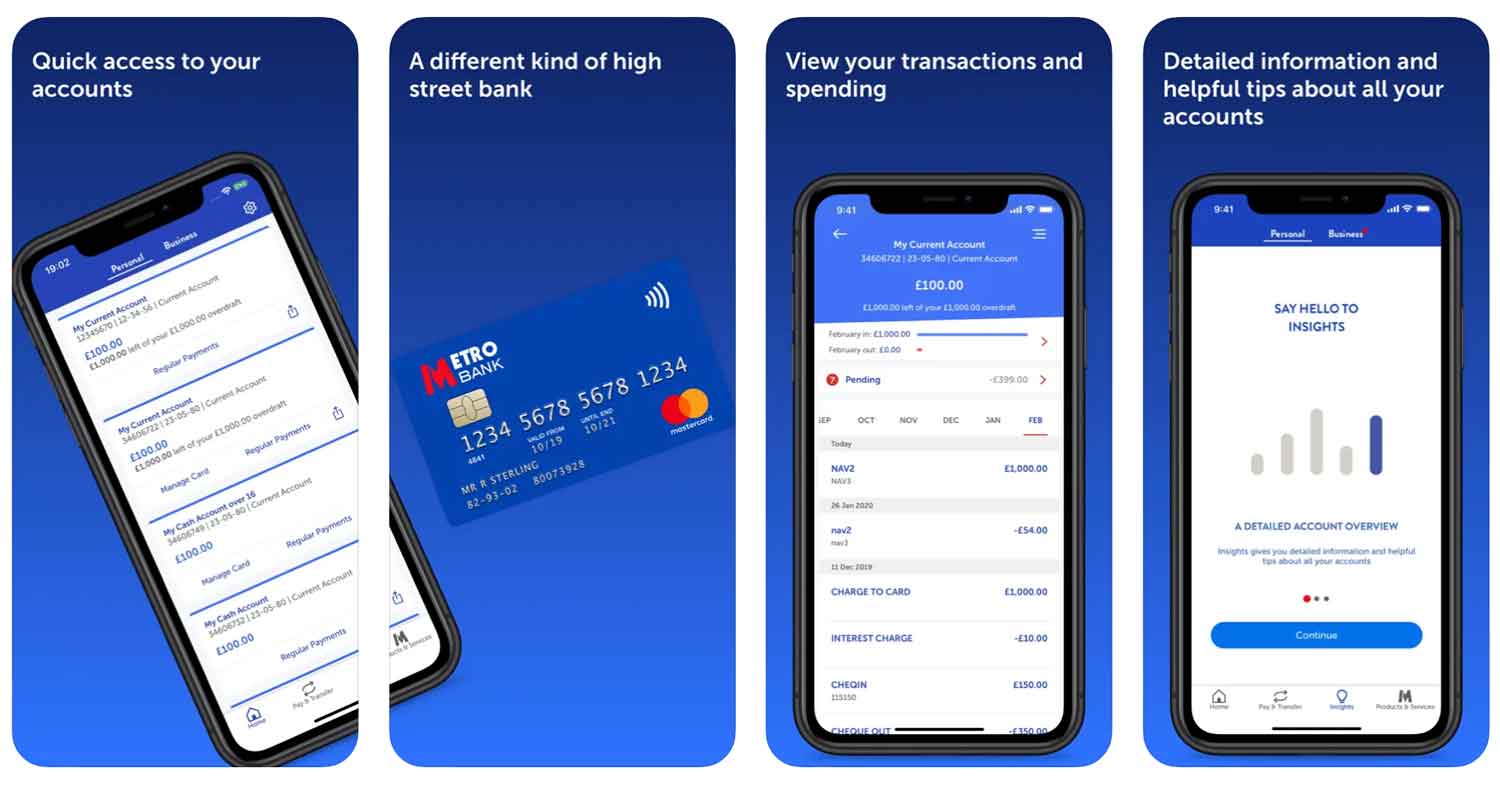

| App downloads | iOS; Android |

| Website | www.metrobankonline.co.uk/business |

| Number of branches | 76 |

| FSCS protected? | Yes |

| Founded | 2010 |

Metro Bank business loans and finance

Metro Bank also offers lending streams to business customers:

- Metro Bank business credit card

- Metro Bank business loans

- Metro Bank invoice finance

- Metro Bank asset finance

Metro Bank business credit card

No monthly fees and an impressive fixed rate APR of 14.9%.

Metro Bank business loans

Business loans are available at a fixed rate APR of 9.6%, no matter how much you borrow and for how long. See business loans.

Metro Bank invoice finance

Stay on top of your business cash flow by accepting an advance on outstanding invoices from Metro Bank, receiving the remainder – minus a fee – when the bill is settled by your customers. See our guide to invoice factoring or merchant cash advance.

Metro Bank asset finance

Borrow a lump sum from Metro Bank for a major investment in equipment or technology, or take out a secured loan against existing assets. See our guide to asset finance.

Metro Bank reviews

What are other business banking customers saying about Metro Bank?

| Review platform | Score | Number of votes |

|---|---|---|

| TrustPilot | 2.5/5 | 4,104 |

| Feefo | Not reviewed | N/A |

| Reviews.co.uk | Not reviewed | N/A |

| Smart Money People | 4.72/5 | 2,819 |

| Which? | Not reviewed | N/A |

| Average score | 3.61/5 | 6,923 |

Metro Bank business eligibility criteria

If you are a UK-based sole trader or SME owner, and your business model is not considered to be high risk or contravene common morality clauses used by mainstream banks, you will likely be approved for a Metro Bank account. If you apply in person at a branch, you’ll walk away from your meeting with an open account and an active debit card on your person.

Metro Bank business finance alternatives

Metro Bank is ultimately a high street institution, and you’ll find no shortage of other banks that fall into this category. Names that have also been around a little longer will also typically offer more features than you will gain from a business account with Metro Bank. What you may not find elsewhere is the superior and dedicated level of customer service provided by Metro Bank.

Metro Bank additional considerations

Metro Bank attracted unwanted in 2020 when it was fined £10,000,000 by the FCA for posting incorrect information surrounding Risk Weighted Assets, and failing to correct this later in the year. This was considered misleading to investors. Some people may consider this a dubious practice that raises concerns about Metro Bank’s conduct at board level.

FAQ

Yes, Metro Bank is a proper bank. Metro Bank is licensed by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority (FCA). It is authorised to provide banking services in the UK under its banking licence. Metro Bank offers current accounts, savings accounts and business banking products as well as credit cards and insurance. It also offers a variety of services such as foreign currency exchange, payment processing and international transfers.

Opening a Metro Bank business account is quick and easy. To get started, you’ll first need to choose the type of account that best suits your needs. Then, you will be asked to provide some personal details, including proof of identification and address as well as financial details about your business. Once all the information has been provided, you can open your business account with Metro Bank.

Metro Bank offers a range of business accounts with different fees and charges. The Business Current Account has no monthly account fee, but there is a fee for withdrawals from ATMs outside the UK. There are also other potential costs associated with services such as overseas payments, cash deposits and cheque deposits.

Metro Bank offers a range of services designed to make banking easier for businesses. These include payment processing, foreign currency exchange, international transfers and cash deposits. The bank also provides additional financial services like invoice finance and overdrafts as well as business insurance products. Additionally, Metro Bank has a dedicated business support team that can provide advice on how best to manage finances.

Metro Bank accepts payments from all major debit and credit cards, as well as direct debits. It also allows customers to pay with PayPal and Apple Pay, and offers an online banking service for making transfers. The bank can also accept international payments in certain currencies. Additionally, Metro Bank customers can use the app to withdraw cash from selected ATMs without the need for a card.

Yes, it is possible to apply for an overdraft with Metro Bank. The bank offers both secured and unsecured Overdrafts, allowing customers to borrow up to £25,000. Depending on the type of overdraft chosen and the customer’s credit history, the interest rate and maximum overdraft limit may vary. It is important to note that an overdraft should only be used for short-term borrowing or as a back up in case of emergencies.