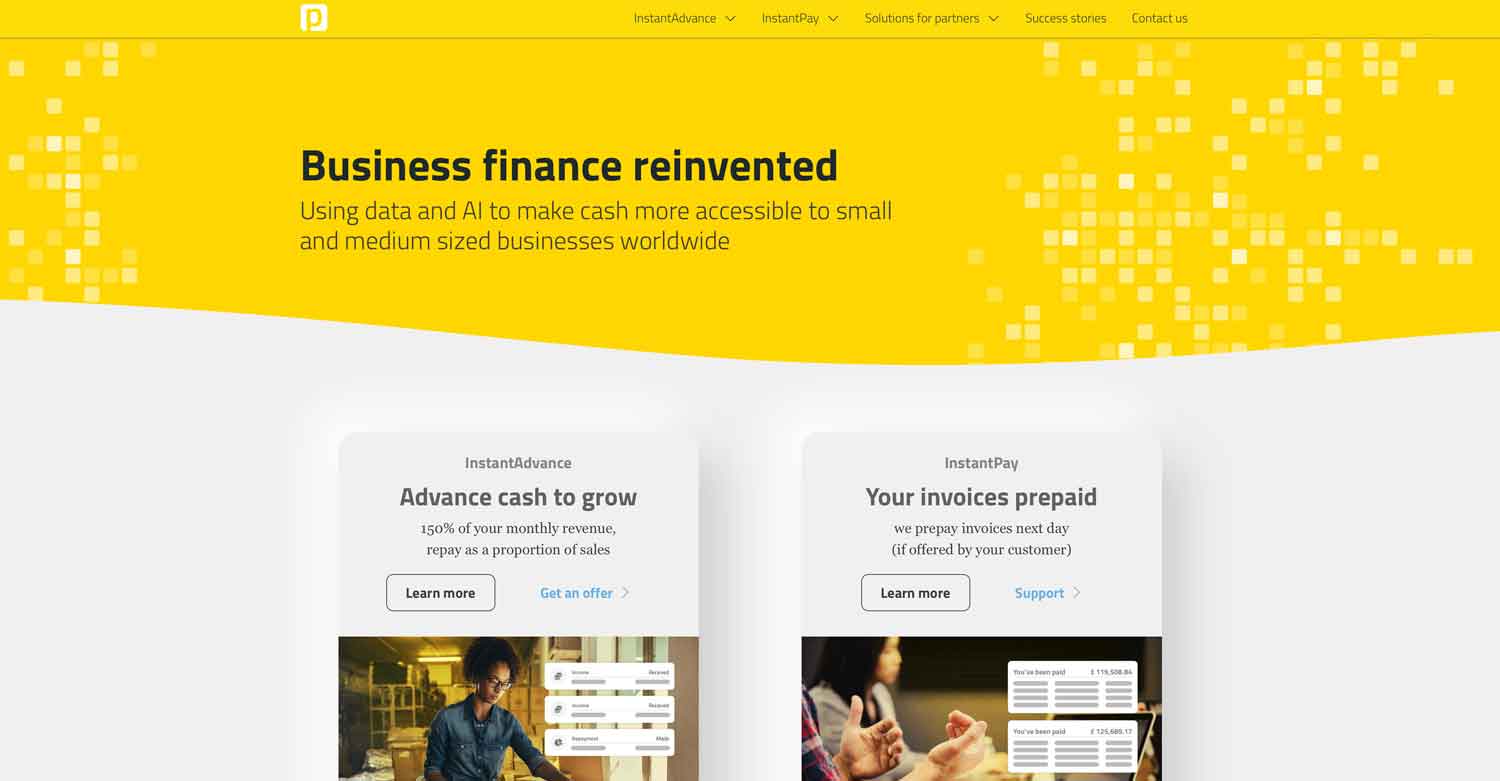

Initially formed in Sweden but now available to SMEs in the UK, Previse is a finance lender that offers merchant cash advances with a difference.

Known as InstantAdvance, you will not need to take payments from debit or credit cards to qualify for this service through Previse, but repayments will still be taken from your future earnings based on monthly turnover.

Featured pro tools

Previse also offers an invoice factoring service called InstantPay, whereby the value of outstanding invoices will be settled immediately minus a processing fee, but you’ll need to be invited to use this service by your customers and clients.

Previse business loans and finance

- Pros and cons

- Merchant cash advance

- Invoice finance

- Business loans

- Asset finance

- Commercial mortgages

- Business vehicle finance

- Business credit cards

- Previse key information

- Previse reviews

- Business eligibility criteria

- Business finance alternatives

- Additional considerations

- FAQ

Pros and cons of Previse for business finance

| Pros | Cons |

|---|---|

| ✓ InstantAdvance is a merchant cash advance available to businesses that do not take card payments | ✗ Must have been trading for at least 12 months to qualify for borrowing |

| ✓ Rapid eligibility checker and payment on successful applications | ✗ Must be invited to use the InstantPay invoice factoring service by a client or customer |

| ✓ Flexible repayment terms on an InstantAdvance based on your monthly turnover | ✗ InstantAdvance lending is short-term and due to be repaid in full within 12 months |

| ✗ No online reviews |

Merchant cash advance

Previse offers a service called InstantAdvance that acts as a merchant cash advance. Unlike most offerings of this ilk, however, you will not need to take payments by debit or credit card to qualify.

Submit your financial records to Previse and this lender will potentially loan you a sum of money between £25,000 and £2,000,000 – the maximum amount you can borrow will depend upon your average monthly turnover.

Previse will then automatically take repayments from your future earnings – plus a service fee – by direct debit for up to 12 months.

Previse will regularly review your turnover and potentially adjust the amount you are expected to repay accordingly. This means you may pay more during lucrative trading seasons, and less when things are quiet.

Invoice finance

Previse offers an invoice factoring service called InstantPay for businesses that have been invited to use this service by clients and customers.

If you utilise the InstantPay service, all invoices to set vendors will automatically be uploaded to a portal provided by Previse. If Previse agrees that your invoices qualify for lending, they will release the full invoice value immediately, minus a fee.

Previse will then take over credit control of the invoice, claiming the funds due from your client or customer.

Business loans

As InstantAdvance and InstantPay are not traditional, lump sum business loans, see the entries above to confirm the lending options available through Previse. See our guide to business loans for more traditional options.

Asset finance

✗ Not available through Previse. See asset finance.

Commercial mortgages

✗ Not available from Previse. See commercial mortgages.

Business vehicle finance

✗ Not available from Previse. See business vehicle finance.

Business credit cards

✗ Not available from Previse. See best business credit cards.

Previse key information

| Phone number | 020 8124 4770 |

| App downloads | N/A |

| Website | previ.se |

| Number of branches | N/A |

| FSCS protected? | No |

| Founded | 2016 |

Previse reviews

| Review platform | Score | Number of votes |

|---|---|---|

| TrustPilot | Not reviewed | N/A |

| Feefo | Not reviewed | N/A |

| Reviews.io | Not reviewed | N/A |

| Smart Money People | Not reviewed | N/A |

| Which? | Not reviewed | N/A |

| Average score | No online reviews | 0 |

Business eligibility criteria

If you wish to borrow from Previse, you will need to be a UK-based business owner that has been trading for at least 12 months, and be willing to share a year’s worth of financial statements with Previse. If you wish to take advantage of the InstantPay invoice factoring service, you will also need to have been invited to do so by your client or customer.

Business finance alternatives

Previse is somewhat unique in its approach to funding, but you’ll find no shortage of alternative suppliers of invoice factoring and merchant cash advances – though, in the case of the latter, you’ll find your options considerably more limited.

Additional considerations

Previse is always looking to increase its offering so more SMEs can access much-needed funds, raising $18,000,000 in funding in 2022 to further enhance innovation and tools.

FAQ

You can call Previse on 020 8124 4770 to discuss your needs, or fill in an online application for the lending stream that your business requires.

The loan that Previse is willing to provide your business will depend upon your monthly turnover. The minimum sum Previse will offer as an InstantAdvance is £25,000, and the maximum is £2,000,000. If you sign up for InstantPay you will receive the full value of an invoice, minus a fee.

Fees in an InstantAdvance loan begin at 4%. The fee assigned to InstantPay will be assigned upon application and acceptance, starting at 1% of the invoice value per 30 days.

No, Previse will be completely transparent about how much you will need to pay in fees when using the InstantAdvance or InstantPay services.

No, all lending through Previse is exclusively attached to your business trading and will not be linked to your personal finances.

You will not be financially penalised with fees or penalties if your client exceeds payment terms on an invoice managed through InstantPay, but you will be eligible for an additional charging period until the debt is settled.