Start Up Loans is a subsidiary of the British Business Bank, owned by HM Government.

While this obviously offers a significant air of official status, do not be fooled by the name – British Business Bank is not actually a bank, and is thus not protected by the FSCS or regulated by the FCA.

Featured pro tools

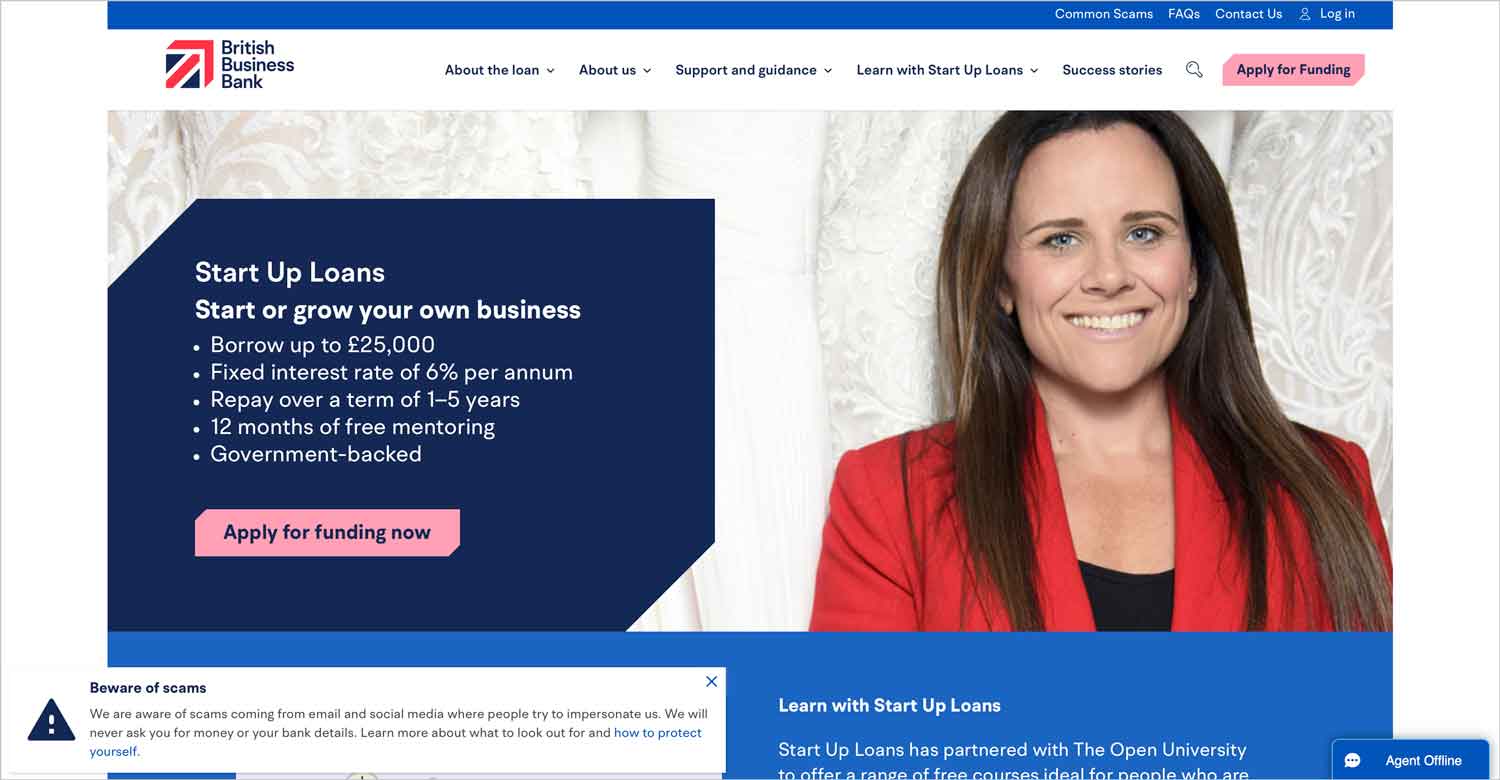

Start Up Loans offers funding of up to £25,000 to an aspiring UK-based businessperson that cannot gain financing from other sources, or a company that has been active for less than 36 months.

Start Up Loans business loans and finance

- Pros and cons

- Business loans

- Merchant cash advance

- Asset finance

- Invoice finance

- Commercial mortgages

- Business credit cards

- Business vehicle finance

- Start Up Loans key information

- Start Up Loans reviews

- Business eligibility criteria

- Business finance alternatives

- Additional considerations

- FAQ

Pros and cons of Start Up Loans from British Business Bank

| Pros | Cons |

|---|---|

| ✓ May be willing to provide funds when other lenders refuse | ✗ As the name suggests, only open to start ups and young businesses |

| ✓ Not set-up fees or early repayment fines | ✗ May not release funds as quickly as a private lender |

| ✓ Single, fixed interest rate of 6% | ✗ Poor TrustPilot reviews |

| ✓ Business mentoring included in the package |

Business loans

Start Up Loans offers funding to somebody looking to start a business, or companies that have been in operation for less than 36 months. Depending on your circumstances you may be able to borrow up to £25,000, but the average loan amount is closer to £7,000.

Your loan will be repaid monthly for anywhere from one to five years, and all loans from this provider are issued with a fixed interest rate of 6%. You will need to pass a credit check (linked to your personal finances – you will be liable for this loan as an individual) and prove that you will be capable of keeping up with the scheduled repayments.

Business lending from Start Up Loans comes with a range of perks, including business mentoring and discounts on certain partner products. Your funding will not come from the Bank of England or a central vault, but an approved partner of British Business Bank.

Merchant cash advance

✗ Not available from Start Up Loans. See merchant cash advance.

Asset finance

✗ Not available from Start Up Loans. See best asset finance.

Invoice finance

✗ Not available from Start Up Loans. See invoice factoring.

Commercial mortgages

✗ Not available from Start Up Loans. See best business credit cards.

Business credit cards

✗ Not available from Start Up Loans. See best business credit cards.

Business vehicle finance

✗ Not available from Start Up Loans. See commercial mortgages.

Start Up Loans key information

| Phone number | 0344 264 2600 |

| App downloads | N/A |

| Website | www.startuploans.co.uk |

| Number of branches | N/A |

| FSCS protected? | No |

| Founded | 2012 |

Start Up Loans reviews

| Review platform | Score | Number of votes |

|---|---|---|

| TrustPilot | 2.2/5 | 197 |

| Feefo | Not reviewed | N/A |

| Reviews.io | Not reviewed | N/A |

| Smart Money People | Not reviewed | N/A |

| Which? | Not reviewed | N/A |

| Average score | 2.2/5 | 197 total votes |

Business eligibility criteria

To qualify for borrowing from your Start Up Loans from British Business Bank, you must meet the following criteria.

- Be based in the UK

- Have a comprehensive business plan, or be a company with less than 36 months of trading history

- Have a business plan or turnover that suggests you can make repayments, with evidence of funding for how you will make repayments if your business does not generate the anticipated income

- Be unable to source funding elsewhere (you can declare this yourself, you will not need to damage your credit rating by applying for dozens of loans and being declined by each as evidence)

- Not be using the loan to service debt, undertake training or education, or make investments

- Satisfy the business industry criteria. Unless you operate in a high-risk field, such as pharmaceuticals, adult entertainment, or gambling, this should not be a problem

Business finance alternatives

Start Up Loans may be the only place you can turn for funding if your business is yet to begin trading, or has only just started generating revenue, but it’s always worth investigating other options from private lenders if you qualify for borrowing elsewhere.

You may find a better interest rate, or be able to avoid being held personally liable for the loan.

Additional considerations

If you accept funding from Start Up Loans, you will need to remain a UK resident until the loan is repaid in full. Do not apply for borrowing from this lender if you plan to move your business interests overseas.

FAQ

Call Start Up Loans on 0344 264 2600 to discuss your options, or fill in the online application form and wait for a callback.

Start Up Loans does not lend to borrowers directly. Instead, the funds provided come from partner investors, who will be repaid – plus interest – as per your loan terms.

If you can prove that you can keep up with the repayments, you could be eligible to borrow up to £25,000 from Start Up Loans. A business with up to four directors can each apply for this funding – the most Start Up Loans will lend any single business is £100,000.

Start Up Loans aims to issue payments as quickly as possible, but does not have a reputation as the fastest lender in the game.

While a loan from this provider is unsecured so your property or assets will not be at risk, defaulting on repayments will damage your personal credit score as you will be liable for this borrowing as an individual, not a business. British Business Bank may also initiate proceedings to recover lost revenue, such as enlisting the services of a debt repayment service.

No, Start Up Loans all have a fixed interest rate of 6% that remains in place until the debt is repaid in full. There are no early repayment penalties of your business takes off and you are in a position to settle the balance in full before the end of the term.