Are you considering Co-Operative Bank business banking? The Co-op Bank is a financial institution with a social conscience. This bank refuses to trade with any supplier that fails to meet their personal moral code, having nothing to do with the arms trade, the production of fossil fuels that damage the environment, or pharmaceutical or scientific bodies that conduct animal testing.

If this does not exclude your business model from banking with the Co-operative Bank, and you’re not deterred by the limited branch presence of this high street bank, you may be tempted by the 30 months of free business banking provided by some accounts – and, of course, the feeling of well-being provided by entrusting your funds to such as ethically-focused business.

Featured pro tools

Co-operative Bank business banking services

- Pros and cons

- Business current accounts

- Business overdrafts

- Business savings accounts

- Co-operative Bank at a glance

- Co-op business loans and finance

- Co-operative Bank reviews

- Co-operative Bank business eligibility criteria

- Co-operative Bank business finance alternatives

- Co-operative Bank additional considerations

- FAQ

Pros and cons of Co-operative Bank for business banking services

| Pros of Co-operative Bank | Cons of Co-operative Bank |

|---|---|

| ✓ 30 months free banking on some accounts | ✗ Small branch presence |

| ✓ A bank with a social conscience | ✗ Can be picky about accepting applications |

| ✓ FSCS protected | ✗ High microtransaction charges |

Business current accounts

Co-operative Bank offers a choice of five business bank accounts to business customers, which come at varying price points and offer a diverse selection of benefits and drawbacks:

- Co-op FSB account

- Co-op Business Directplus account

- Co-op Business current account

- Co-op Cash Deposit business bank account

- Co-op Standard Tariff business account

Co-op FSB account

Exclusively for members of the Federation of Small Businesses, this is the most cost-effective Co-operative Bank account – it’s completely free to run, with no monthly fee or microtransaction charges except an 80p charge for cash transactions beyond £1,000.

Co-op Business Directplus account

This account is free for 30 months, unless your balance drops below £1,000, in which case a monthly fee of £7 will be levied. This account is designed for start-ups, sole traders, and small businesses. Keep your balance above £1,000 after the initial 30-month period expires to minimize microtransaction fees – if you fail to do so, you’ll be charged 70p for every electronic debit and debit card purchase, as well as fees for all cash and cheque transactions.

Co-op Business current account

A more straightforward version of the Business Direct plus account. This account is free for 30 months, after which you will be charged £10 per month, but all non-cash or cheque transactions are free regardless of your account balance.

Co-op Cash Deposit business bank account

Charged at £10 per month with no free period, this account reduces the fees associated with handling cash, but does charge 10p for every electronic transfer in or out of your account. It’s only really worth considering if the vast majority of your transactions are cash-based.

Co-op Standard Tariff business account

Being honest, we can’t imagine why anybody would choose this over a standard Business Account. It costs £10 per month with no free period, and every transaction you undertake will come with a fee, ranging from 20p to 80p.

Business overdrafts

The Co-operative Bank offers a business overdraft of up to £25,000 to business account holders, though a higher limit is available subject to approval and review. The interest rate will be assigned upon successful application. If you are an FSB member you will not be charged an annual fee for your overdraft.

Business savings accounts

The Co-operative Bank offers three business savings accounts to business customers:

Business Instant Access Account

Save anything from £1 in an account that can be accessed and withdrawn from at any time. Your savings will accrue interest at an AER of 1.28%, calculated and payable twice a year.

35 Day Business Notice Account

No minimum or maximum balance, and funds can be withdrawn with 35 days of notice. Interest is calculated at an AER of 1.59% and is payable twice a year.

95 Day Business Notice Account

No minimum or maximum balance, and funds can be withdrawn with 95 days of notice. Interest is calculated at an AER of 1.96% and is payable twice a year.

Co-operative Bank at a glance

| Phone number | 0345 721 2212 |

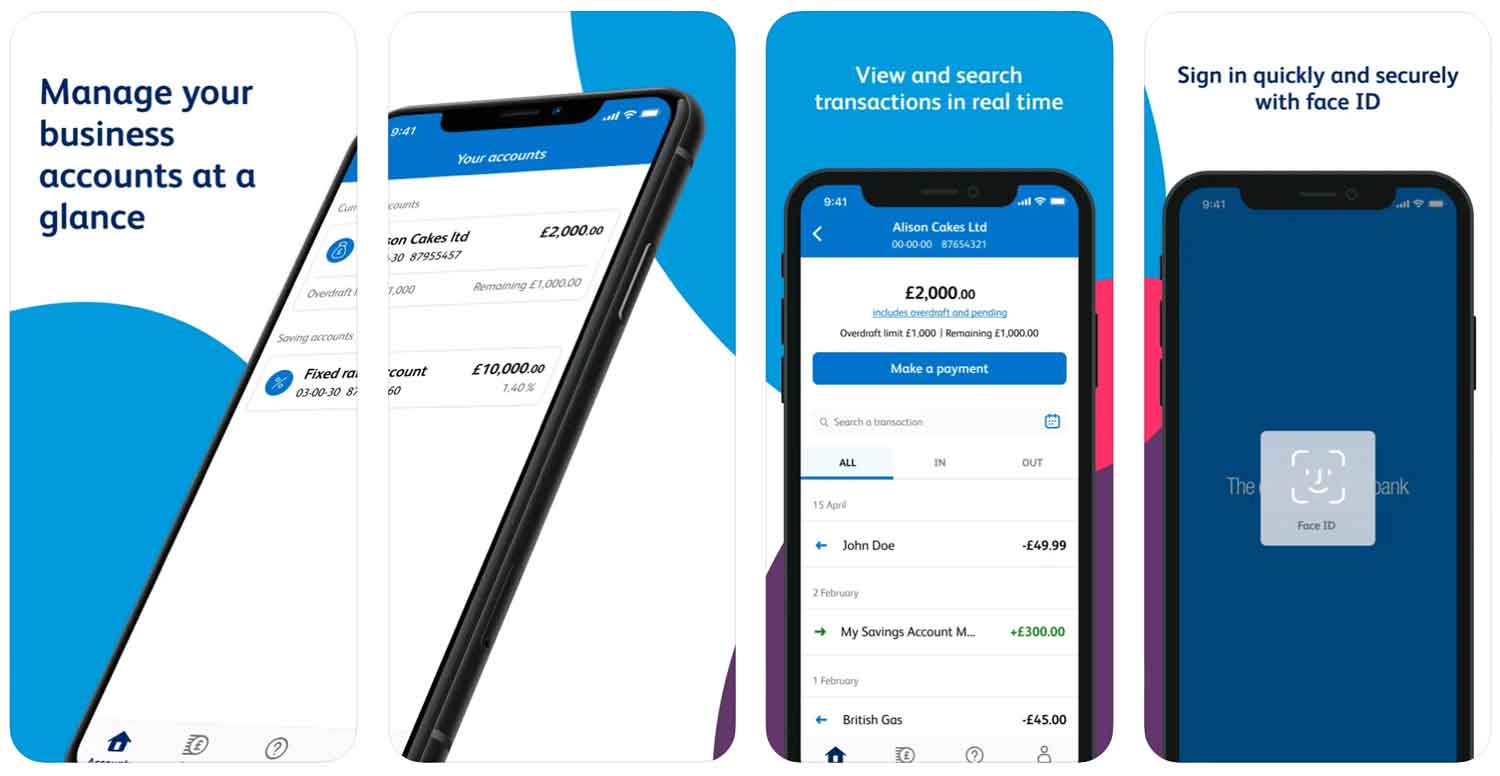

| App downloads | iOS; Android |

| Website | www.co-operativebank.co.uk/business |

| Number of branches | 50 |

| FSCS protected? | Yes |

| Founded | 1872, Manchester |

Co-op business loans and finance

The Co-operative Bank offers other financial products to business account holders.

Business credit card

A standard business credit card with a representative APR of 21.8%, a maximum credit limit of £25,000, and 56 days of interest-free spending. See best business credit cards.

Business Charge Card

Enjoy up to 48 days of interest-free transactions if you clear your balance in full each month.

Variable Rate Interest business loan

Take out a business loan between £25,020 and £10,000,000, repayable for up to 20 years at a variable interest rate. Interest-only repayment periods are also available. See best business loans.

Commercial mortgages

Apply for up to £10,000,000 in funding for a commercial mortgage, repayable for up to 20 years.

Renewable energy funding

As part of the Co-operative Bank’s dedication to clean energy, loans of up 100% are available – repayable with interest – if you produce a business plan that will improve your business’s environmental standing.

Co-operative Bank business banking reviews

What are other business banking customers saying about Co-operative Bank?

| Review platform | Score | Number of votes |

|---|---|---|

| TrustPilot | 2.6/5 | 3,504 |

| Feefo | Not reviewed | N/A |

| Reviews.co.uk | Not reviewed | N/A |

| Smart Money People | 3.65/5 | 468 |

| Which? | Not reviewed | N/A |

| Average score | 3.125/5 | 3,572 |

Co-operative Bank business eligibility criteria

Co-operative Bank can be a little fussy about who is accepted to open a business account. As well the ethical considerations – remember that this bank refuses to trade with some industries outright – you must have a clean financial history and no negative balance on your business accounts for the last year. If you have been prone to dipping into an overdraft, the Co-operative Bank is not for you.

Co-operative Bank business finance alternatives

If you are keen to use your business savings for a good cause, consider saving with Charity Bank as an alternative to the Co-operative Bank. If you are just considering a business current account, other high street banks will offer greater options when it comes to lending and will likely be less fussy about accepting your application. Consider a medium-sized alternative like TSB if you want to avoid the “big four.”

Co-operative Bank additional considerations

As a small bank in an uncertain economic climate, there is always a chance that the Co-operative Bank will be forced to merge with a larger rival to survive. The bank’s owner has admitted this is a distinct possibility. Consider whether you are happy to potentially find your finances under the control of a much bigger name down the line.

FAQ

Yes, Co-operative Bank is a proper bank. It is registered with the Financial Conduct Authority (FCA) and Prudential Regulatory Authority (PRA). As a proper financial institution, it offers customers a wide range of services such as banking and savings accounts, credit cards, loans and mortgages.

Opening a Co-operative Bank business account is easy. You can apply online or in person at a local branch. To open the account you will need to provide proof of identity, address and financial information such as annual turnover, assets and liabilities. Additionally, you may also be required to provide references from suppliers or customers. Once your application has been approved your account can be opened within a few days.

Co-operative Bank offers competitive fees for its products and services. Fees vary depending on the type of account you open and may include an overdraft fee, transaction charges or monthly maintenance fees. Other fees such as those associated with loan applications may also apply.

Co-operative Bank offers a wide range of services for its customers. These include current and savings accounts, credit cards, loans and mortgages. Customers can also take advantage of the bank’s online banking service which allows them to manage their finances from any location using their computer or mobile device. The bank also offers specialised services such as international money transfers and currency exchange services. Additionally, Co-operative Bank also provides a variety of other products and services such as travel insurance, home insurance and car finance.

Co-operative Bank accepts various types of payments including debit cards, credit cards, direct debits and cheques. The bank also offers its customers the option to pay bills online using their internet banking facility. Additionally, Co-operative Bank also provides payment services such as standing orders and BACS transfers.