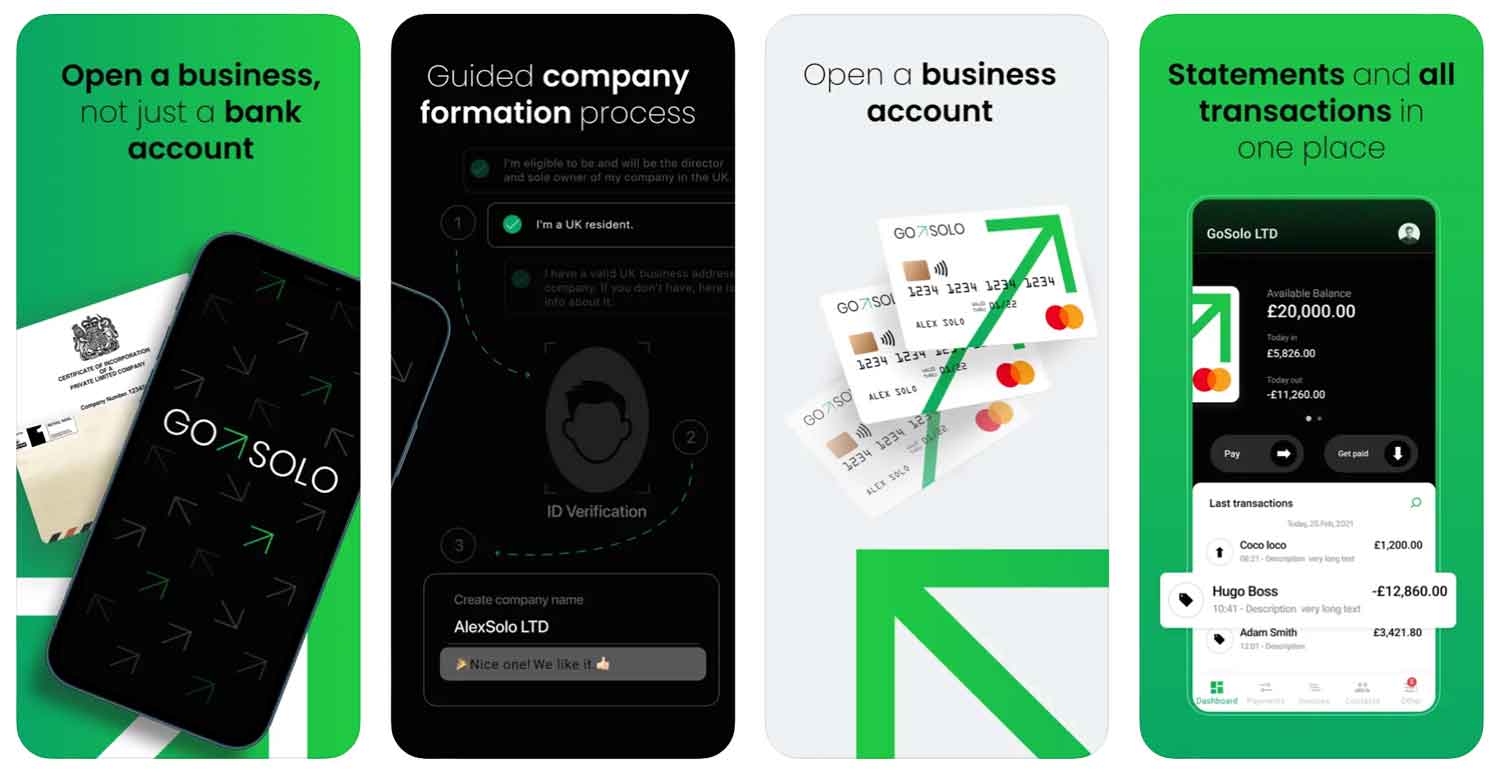

GoSolo is a one-stop-shop for any new business owner that does not know where to start with their business banking.

As well as providing financial services, this challenger bank helps you set up and register your business with Companies House, as well as managing your credit control. GoSolo can also provide a virtual UK address for overseas entrepreneurs and expats that are no longer eligible for a British bank account.

Featured pro tools

This is an admirable toolkit that is ideal for novice business owners that are seeking support with getting themselves up and running, or more critically, anybody that wishes to operate a British bank account from abroad and cannot supply a valid UK residential address.

GoSolo business banking services

- Pros and cons

- Business current accounts

- Business overdrafts

- Business savings accounts

- GoSolo at a glance

- Other business finance products

- GoSolo reviews

- GoSolo business eligibility criteria

- GoSolo business finance alternatives

- GoSolo other considerations

- FAQ

Pros and cons of GoSolo for business services

| Pros of GoSolo | Cons of GoSolo |

|---|---|

| ✓ Register your business within the app | ✗ A little limited for established business owners |

| ✓ Offers overseas traders a virtual UK address | ✗ Not a bank, and thus not FSCS protected |

| ✓ Accounts usually opened within 10 minutes | ✗ No telephone support |

Business current accounts

GoSolo offers three current accounts to business customers:

Each can be integrated with the accounting software Xero, and will furnish you with a MasterCard business debit card. You can also send invoices and receive payments from within the GoSolo app.

GoSolo Business Account

Completely free to open and run, with the option of GoSolo forming and filing your business with Companies House for a fee of £25. This is twice the price of a DIY approach, but could save you a lot of administration and potential headaches.

GoSolo All-Inclusive Package

This accounts costs £199 to open, and an annual renewal fee of £175. Company registration is free with this account, and you will also be furnished with a virtual UK company address for correspondence. You must be based in the UK to open an account using the All-Inclusive Package.

GoSolo Global Founder Package

This is the All-Inclusive package for people based outside the UK. For a registration fee of £499, and an annual renewal cost of £249, you can open a GoSolo account and obtain a virtual UK address from any one of 90 supported overseas territories.

Business overdrafts

✗ Not available through GoSolo. See best business overdrafts.

Business savings accounts

✗ Not available through GoSolo. See best business savings accounts.

GoSolo at a glance

| Phone number | N/A – GoSolo does not offer telephone support |

| App downloads | iOS; Android |

| Website | www.gosolo.net |

| Number of branches | N/A |

| FSCS protected? | No |

| Founded | 2019 |

Other business finance products

✗ GoSolo does not offer business financial services beyond those we have discussed. This means it is best used by SME owners based overseas that need a virtual UK address.

GoSolo reviews

What are other business banking customers saying about GoSolo?

| Review platform | Score | Number of votes |

|---|---|---|

| TrustPilot | 3.0/5 | 63 |

| Feefo | Not reviewed | N/A |

| Reviews.co.uk | Not reviewed | N/A |

| Smart Money People | Not reviewed | Not reviewed |

| Which? | Not reviewed | N/A |

| Average score | 3.0/5 | 63 |

GoSolo business eligibility criteria

GoSolo plays its cards close to its chest when it comes to criteria for acceptance for an account, and will not guarantee that anybody will be accepted – though most accounts are approved and opened within 10 minutes. The usual caveats apply – you must be aged 18 or over, and if you wish for GoSolo to register your business, you cannot be disqualified to act as a company director. Unless you spend big and go for the Global Founder package, you’ll also need to provide proof of address within the UK.

GoSolo business finance alternatives

There are not really any direct comparisons to GoSolo, but if you’re in the UK you could save yourself £13 by registering your business with Companies House yourself and registering for a Mettle challenger bank account, as that is also devoid of monthly or microtransaction charges. If you’re not in the UK, GoSolo remains well worth your attention.

GoSolo other considerations

GoSolo is regulated, but it’s not a bank. Use this service at your own risk, as your money will not be protected by the FSCS.

FAQ

No, GoSolo is not a traditional bank. While it offers money management and payment solutions, GoSolo is not a bank in the traditional sense. It is an online platform that provides users with financial tools to manage their money and make payments using their smartphones or desktop computers.

Opening a GoSolo business account is easy and secure. To open an account, you must first create a free business profile and provide some basic information, such as your name, address, phone number, and email address. After that, you will be prompted to set up your payment methods. You can use debit cards or credit cards to fund your GoSolo business account. Once you have set up your payment methods, you can begin using the platform to manage and transfer money. You can also take advantage of features such as automated invoicing and payroll processing.

GoSolo has no monthly fees or minimum balance requirements. It only charges a fee when you make a payment using the platform, which is typically 1% of the payment amount. It also offers discounts for larger payments and international transfers. The exact fee structure may vary depending on your plan and type of transaction.

GoSolo offers a variety of services to help you manage your money. These include digital wallets, payment cards, automated invoicing and payroll processing, budgeting tools, and international transfers. It also provides access to banking services such as deposits and withdrawals via its partner banks.

GoSolo accepts payments from both debit and credit cards. You can also use digital wallets, such as Apple Pay and Google Pay, to make payments on the platform. GoSolo also supports international transfers in multiple currencies, making it a great option for businesses that do business internationally. It also offers direct deposits for payroll services as well as recurring payments for subscription services.

GoSolo takes security very seriously and has implemented a number of measures to protect its users. The platform is protected by 256-bit encryption and is PCI compliant, so your data is secure.