Are you considering Allied Irish Bank business banking? The banking sector in Ireland has been undergoing a little turmoil in recent years, but for SMEs and sole traders based in the country, Allied Irish Bank has remained a comfortingly consistent presence. Allied Irish Bank GB is a division of the parent institution with 21 branches in Great Britain.

Specialising in business transactions, AIB offers a business account with low maintenance fees (tempered by high microtransaction fees) and a range of lending streams. As you can probably imagine, this bank is most suitable for SMEs and sole traders with Irish connections, whether in terms of trade or geography, though the British subdivision naturally trades in sterling rather than euros.

Featured pro tools

Allied Irish Bank business banking services

- Pros and cons

- Business current accounts

- Business overdrafts

- Business savings accounts

- Allied Irish Bank at a glance

- Allied Irish bank business loans and finance

- Allied Irish Bank reviews

- Business eligibility criteria

- Business finance alternatives

- Additional considerations

- FAQ

Pros and cons of Allied Irish Bank for business services

| Pros of Allied Irish Bank | Cons of Allied Irish Bank |

|---|---|

| ✓ Low maintenance fee of £10 per quarter | ✗ Only 21 branches in Great Britain |

| ✓ Wide range of lending products | ✗ Microtransaction fees can add up |

| ✓ FSCS protected | ✗ Only one business current account |

| ✓ Good interest rates on fixed savings bonds | ✗ Limited and average online reviews |

Business current accounts

Allied Irish Bank offers a single business bank account. This account is cheap to maintain, priced at just £10 per quarter, but there is a range of microtransaction fees to take into account.

Every transaction you undertake, including sending or receiving funds, will attract a fee between 35p and 75p. You’ll need to decide whether an account fee that equates to £2.50 per month plus these charges still makes value for money.

It is also worth noting that, if you wish to use a debit card attached to your AIB account, you need to apply for this separately. It’s free to do so, but that’s another layer of administration that seems unnecessary.

Business overdrafts

Allied Irish Bank offers business overdraft facilities of up to £25,000, with a typical EAR of 6.24%.

Business savings accounts

Allied Irish Bank offers two business savings accounts to business customers:

Demand Deposit Account

This is an instant access account with no minimum or maximum deposits. Interest is calculated daily at an interest rate of 0.60%, and paid at the end of every financial year.

Fixed Term Deposit

Allied Irish Bank business customers will enjoy superior interest rates on savings by using a fixed term deposit. You will need to deposit at least £5,000 to open on of these bonds, but there is no maximum balance.

The longer you secure your funds in an inaccessible bond, the more interest you will accrue upon maturation. The interest rates are as follows:

| Type of deposit account | Interest rate |

|---|---|

| 3 month savings bond | 2.75% AER |

| 6 month savings bond | 3.25% AER |

| 1 year savings bond | 3.75% AER |

| 2 year savings bond | 4% AER |

Allied Irish Bank at a glance

| Phone number | 0345 600 5204 |

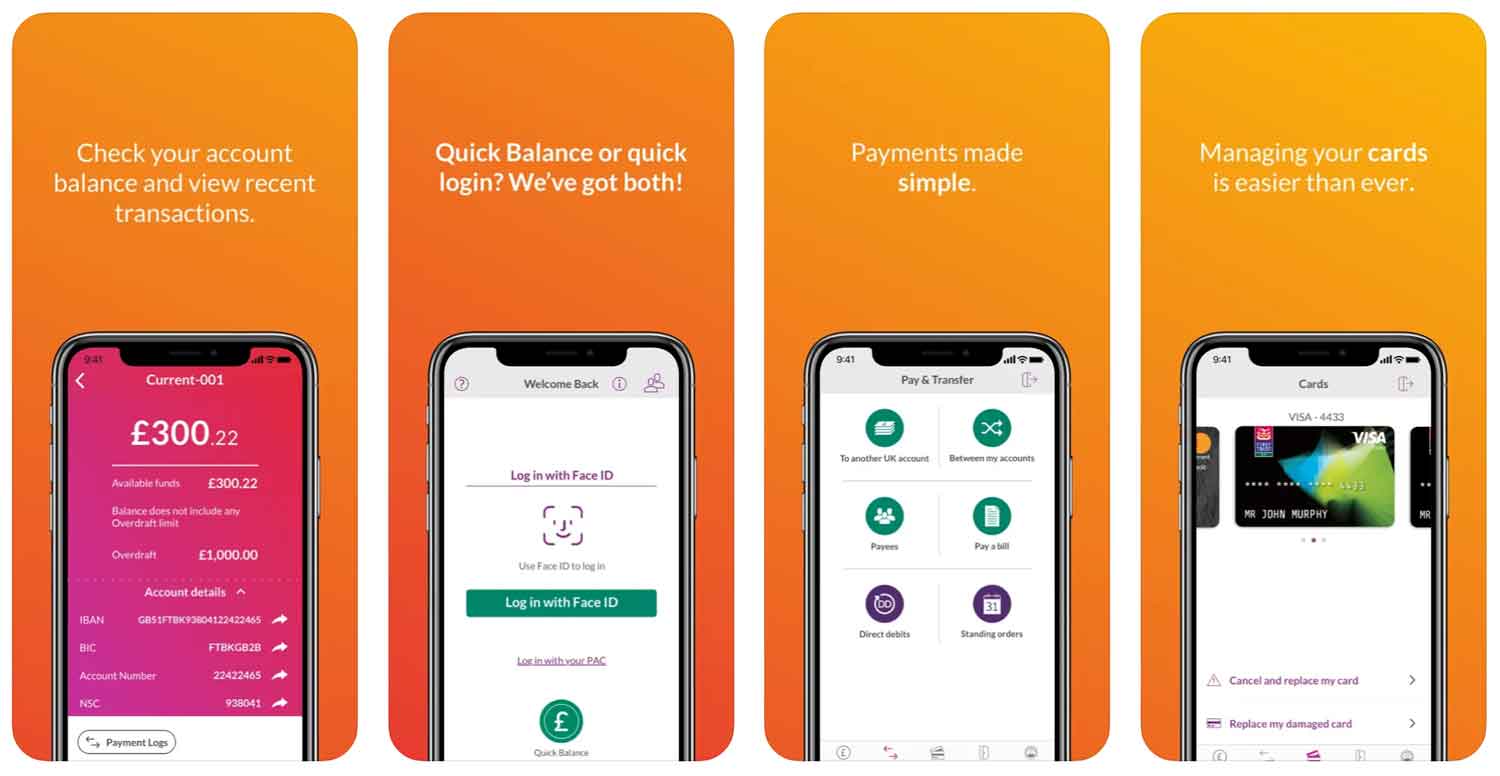

| App downloads | iOS; Android |

| Website | www.aibgb.co.uk |

| Number of branches | 21 |

| FSCS protected? | Yes |

| Founded | 1985, Uxbridge (Allied Irish Bank in general was founded in 1966) |

Allied Irish bank business loans and finance

Allied Irish Bank offers numerous additional financial products for business customers:

Visa Business card

A Visa credit card with a representative APR of 4.0% and an annual fee of £15 per year, plus a £10 joining fee. Credit limits begin at £500 and spending caps can be placed on the card.

Visa Business Gold card

A Visa credit card with a representative APR of 12.8% and an annual fee of £50 per year, plus a £25 joining fee. Credit limits begin at £5,000 and spending caps can be placed on the card. This card also provides membership to the AA and the Visa Luxury Hotel Collection, making it ideal for frequent business travellers.

Business loans

Allied Irish Bank offers unsecured business loans of up to £25,000 at a representative APR of 8.1%. If you need to borrow more, discuss your application with AIB – the interest rate will be impacted by this additional borrowing.

Invoice finance

Release up to 90% of the value of an unpaid invoice to improve business cash flow and pass credit control to Allied Irish Bank, who will claim the payment and submit the remaining balance after taking a handling fee. See invoice factoring.

Asset finance

Turn to Allied Irish Bank to help finance a major asset purchase, which can be leased from the lender for a monthly fee. See asset finance.

Allied Irish Bank reviews

What are other business banking customers saying about Allied Irish Bank?

| Review platform | Score | Number of votes |

|---|---|---|

| TrustPilot | 2.6/5 | 4 |

| Feefo | Not reviewed | N/A |

| Smart Money People | 2.78/5 | 23 |

| Which? | Not reviewed | N/A |

| Average score | 2.69/5 | 27 |

Business eligibility criteria

Any business owner or sole trader registered in Britain can open an account with Allied Irish Bank GB, though unless you’re in Northern Ireland, you’ll face restrictions when you do so. The usual application caveats apply – you’ll need to be 18 or older, and provide proof of your ID and address, as well as answering questions about your business model.

Business finance alternatives

Business customers based in Northern Ireland, who are presumably the people most interested in opening an Allied Irish Bank GB account, may wish to consider Ulster Bank or Danske Bank as an alternative to AIB.

Businesses in England, Wales, or Scotland should turn to any other high street name, though be warned that AIB’s savings bonds typically offer better interest many many rivals.

Additional considerations

Allied Irish Bank are an entity is government-owned in Ireland, and shares in the bank have recently been sold to the private sector. While there is currently no suggestion that AIB GB will be taken over by another high street bank, this is worth noting.

FAQ

Yes, Allied Irish Bank (AIB) is a proper bank. AIB is one of Ireland’s “Big Four” banks and has been listed on the London Stock Exchange since 1997. It offers personal banking, business banking, corporate banking, wealth management and investment services to customers in the Republic of Ireland and Northern Ireland.

You can open a business account with AIB by visiting your local branch, or you can apply online using the bank’s website. When applying for an account, you will need to provide appropriate documentation such as identification, proof of address and any other required information. Once approved, you will be able to access a range of services including payments and cash management and foreign exchange services. AIB also offers a range of financial advice services to help you manage and grow your business.

Yes, AIB is a highly secure bank offering the latest in security measures for its customers. The bank’s online banking system uses advanced encryption technology to ensure that all transactions are secure. It is also regulated by the Central Bank of Ireland, which ensures that all customer deposits are protected in the event of any financial difficulties. The bank has implemented a variety of other security measures to ensure customer safety and protect against fraud.

AIB offers its customers a variety of personal, business and corporate banking services. This includes current accounts, savings accounts and various types of loans such as mortgages, car finance and personal loans. The bank also offers online banking services, debit cards and credit cards along with investment and wealth management services. Additionally, AIB provides foreign exchange services for businesses trading internationally.

AIB offers competitive fees for its services, including foreign exchange and payments. However, you should check with the bank before committing to any service as fees can vary depending on the type of transaction or account. AIB also charges a fee for using certain ATMs outside of Ireland and Northern Ireland. The bank may also charge additional fees for services such as overdrafts and account maintenance.

AIB accepts a variety of payments, including cash, card and online payments. Cash deposits can be made at any AIB branch or selected Post Office locations. Card payments – such as debit and credit cards – can also be processed through the bank’s online banking system. Additionally, the bank allows customers to make online payments using third-party services such as PayPal and Apple Pay.