Holvi is an app-based bank that promises to “calm the chaos of self-employment” by offering a range of current accounts in a variety of international currencies. That sounds great, but for one significant flaw for UK-based SME owners and sole traders – this is a European service that is not available to British business customers.

Unless you have an account in one of Holvi’s six operational countries (which includes Ireland) you will not be able to use this service for your business finance needs. Thankfully there are plenty of domestic alternatives that offer a greater range of features.

Featured pro tools

Holvi business banking services

- Pros and cons

- Business current accounts

- Business overdrafts

- Business savings accounts

- Holvi at a glance

- Other business finance products

- Holvi reviews

- Holvi business eligibility criteria

- Holvi business finance alternatives

- Holvi additional considerations

- FAQ

Pros and cons of Holvi for business services

| Pros of Holvi | Cons of Holvi |

|---|---|

| ✓ Sliding pricing scale | ✗ Not available for UK-based traders |

| ✓ Simplified in-app bookkeeping services | ✗ Default currency is €, not £ |

| ✗ Limited customer support |

Business current accounts

Holvi offers two business accounts to members that qualify for this service based on geography:

Both accounts are €-centric with an IBAN and SWIFT code, and can include a business debit card linked to your Holvi account that can be used free anywhere in the EU. A small fee of 2-2.5% applies to ATM cash withdrawals.

Holvi Lite account

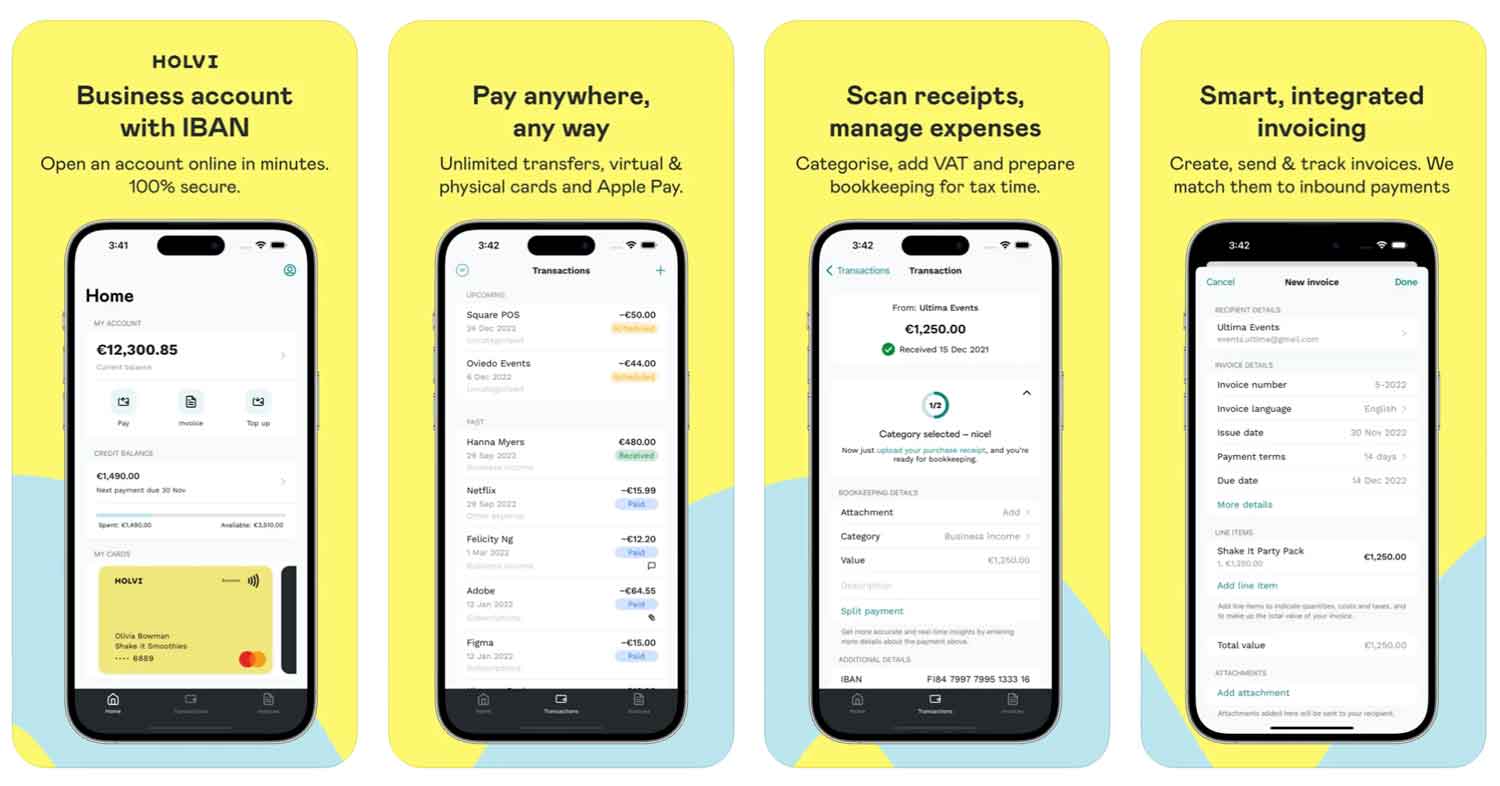

Priced at €9 per month + VAT, this is a basic Holvi account. You can send and receive funds, monitor your income and expenditure through the Holvi app, and use a debit card at no extra charge through the EU for transactions in €.

Holvi Pro account

Charged at €15 per month + VAT, this account provides three debit cards, an option to apply for a Holvi business credit card (additional fees apply,) and greater bookkeeping services, such as the ability to send and receive invoices through the Holvi app.

Business overdrafts

✗ Not available through Holvi. See best business overdrafts.

Business savings accounts

✗ Not available through Holvi. See best business savings accounts.

Holvi at a glance

| Phone number | N/A – online live chat only |

| App downloads | iOS; Android |

| Website | www.holvi.com |

| Number of branches | N/A |

| FSCS protected? | No, but money is secured according to the Financial Supervisory Authority of Finland |

| Founded | 2011, Helsinki |

Other business finance products

✗ Holvi does not provide additional financial services beyond the current accounts we have discussed.

Holvi reviews

What are other business banking customers saying about Holvi?

| Review platform | Score | Number of votes |

|---|---|---|

| TrustPilot | 4.3/5 | 1,646 |

| Feefo | Not reviewed | N/A |

| Reviews.co.uk | Not reviewed | N/A |

| Smart Money People | 3/5 | 1 |

| Which? | Not reviewed | N/A |

| Average score | 3.65/5 | 1,647 |

Holvi business eligibility criteria

As discussed, UK-based businesses are not eligible to apply for a Holvi account. This service is only open to SMEs and sole traders in Austria, Finland, Germany, Ireland, Belgium, or the Netherlands. If you qualify under these grounds, Holvi will accept any business customer aged 18 or over that is not considered high risk.

Holvi business finance alternatives

If you are seeking an account that allows you to hold multiple currencies but you’re based in the UK, consider 3S Money, Airwallex, Wise, or Fair Everywhere as alternatives to Holvi – you can open any of these accounts with a UK trading and residential address.

Holvi additional considerations

In 2022, Holvi was sold back to the co-founder of the app after previously being owned by the multinational finance company Banco Bilbao Vizcaya Argentaria (BBVA.)

FAQ

Yes, Holvi is a proper bank. It is regulated by the Financial Supervisory Authority of Finland and is part of the Eurozone banking system. Holvi offers a range of services from current accounts to card payments and international transfers, making it easy for businesses to manage their finances.

Opening up a Holvi business account is fast and straightforward. All you need to do is signup online with your personal information, verify your identity and provide some supporting documentation about your company. Once the application is approved, you’ll have access to all of Holvi’s features as well as a dedicated customer support team that can help with any queries.

Holvi’s fees vary depending on the type of services you use, but they are generally competitive and transparent. For example, card payments incur a flat fee of 1.50%, while international transfers come with a flat fee of 3.00%. Holvi also offers monthly or annual subscription plans for businesses that require more frequent access to their banking services.

Holvi offers a range of services to businesses, including current accounts, card payments, international transfers, invoicing and reporting. Additionally, Holvi also provides access to online resources such as bookkeeping software and business advice. Businesses can also take advantage of secure storage options for their documents and financial information.

Holvi supports a wide range of payment methods including credit cards, debit cards, and direct bank transfers. Holvi also offers support for Apple Pay and Google Pay so businesses can accept payments quickly and securely. Holvi also allows customers to make international payments in multiple currencies.