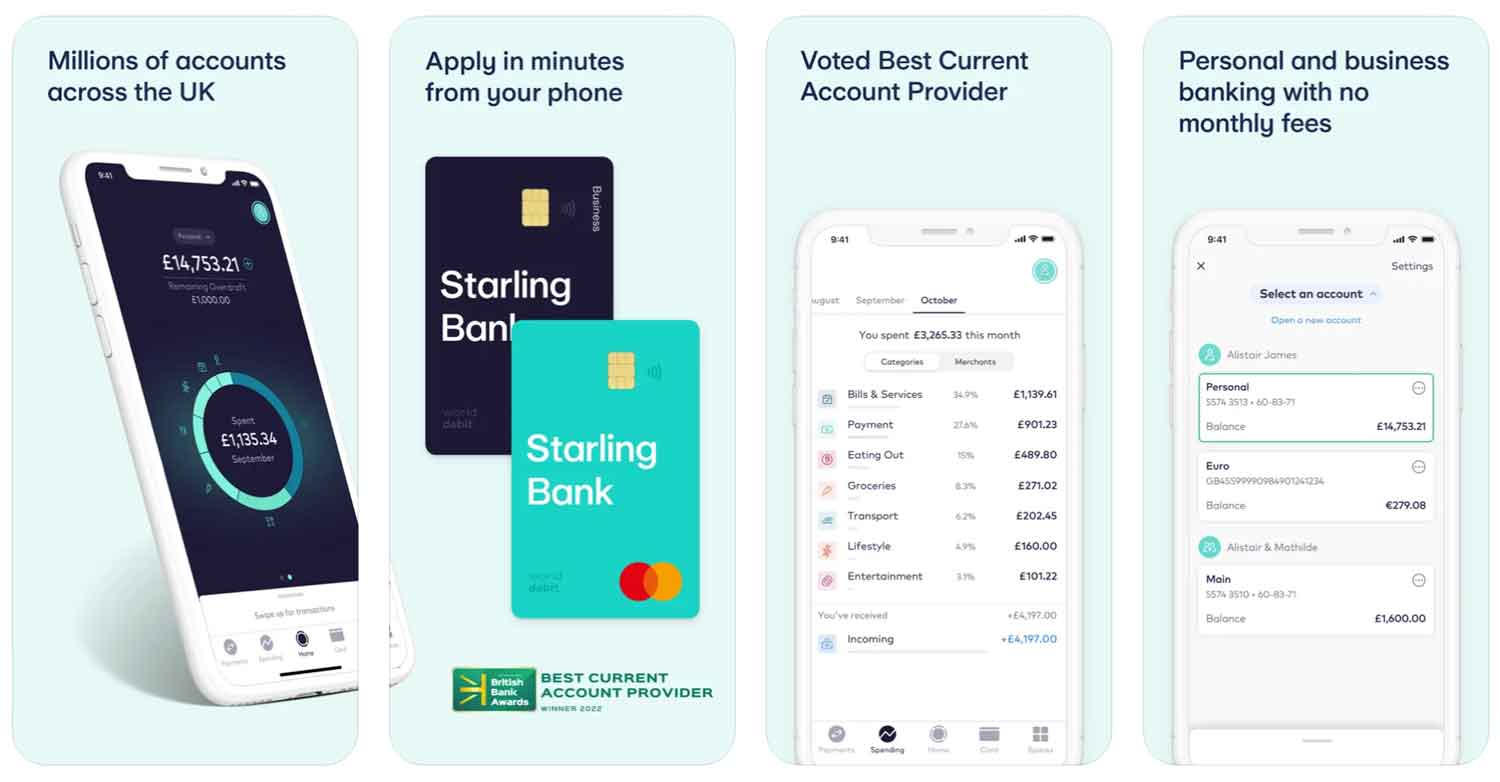

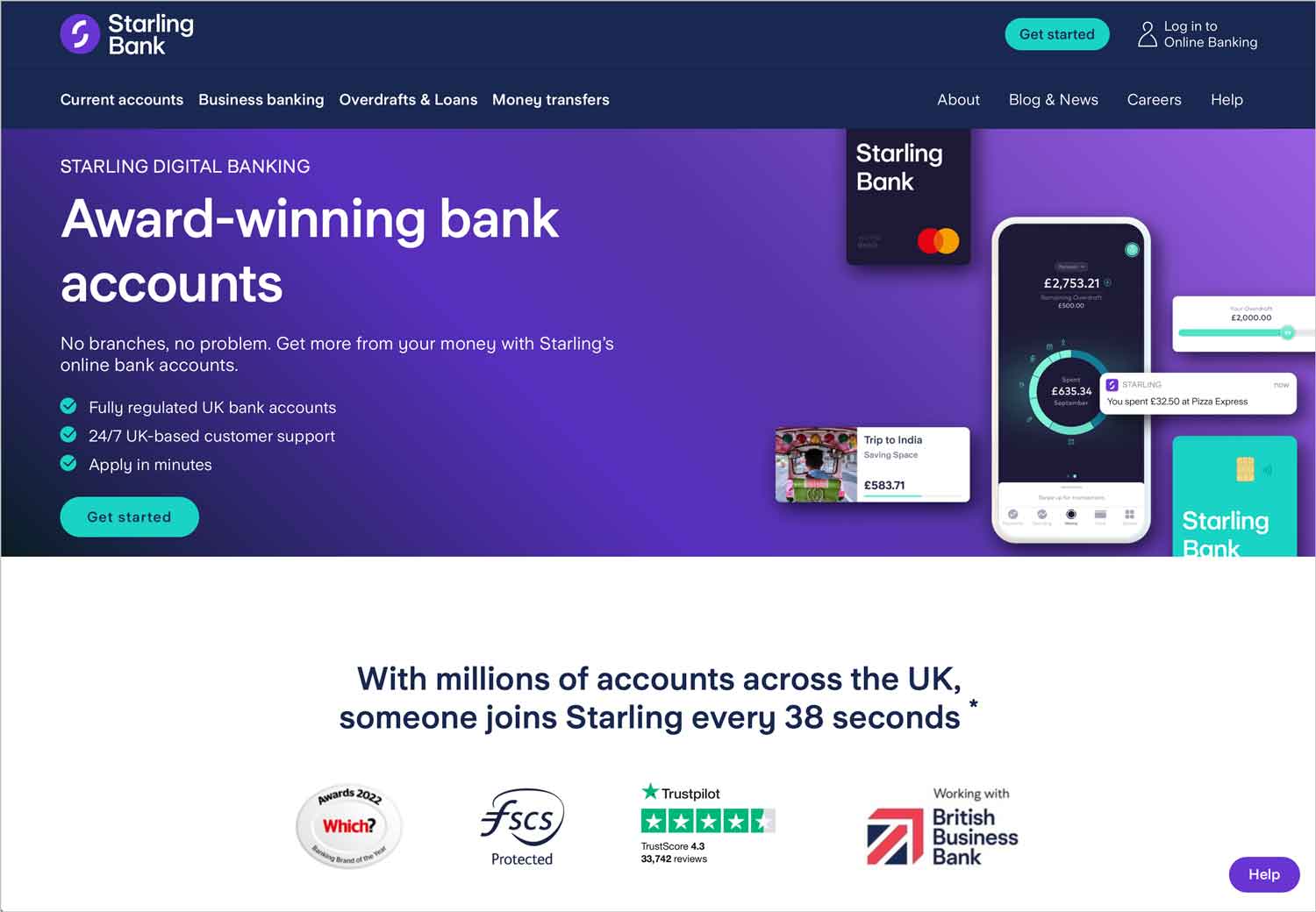

Starling Bank was the first challenger bank to make a mark on the financial realm when it began offered business accounts in 2018, and this provider has continued to go from strength to strength ever since. Starling Bank enjoys a sterling reputation, providing free business accounts designed for SMEs or sole traders, as well as overdraft, savings bond, and business loan facilities.

Unless you are determined to do your business banking in person on the high street, there is no reason not to at least consider Starling Bank for your needs. This bank has a stellar online reputation and is a mainstay at industry awards ceremonies.

Featured pro tools

Starling Bank business banking services

- Pros and cons

- Business current accounts

- Business overdrafts

- Business savings accounts

- Starling Bank at a glance

- Starling Bank business loans

- Starling Bank reviews

- Starling Bank business eligibility criteria

- Starling Bank business finance alternatives

- Starling Bank additional considerations

- FAQ

Pros and cons of Starling Bank for business services

| Pros of Starling Bank | Cons of Starling Bank |

|---|---|

| ✓ No monthly compulsory account fees | ✗ No branch support |

| ✓ Dedicated accounts for SMEs and sole traders | ✗ Cash must be paid at a Post Office, which attracts a fee |

| ✓ Overdrafts, savings bond and loans available | |

| ✓ FSCS protected | |

| ✓ Excellent online reviews and winner of countless industry awards |

Business current accounts

Starling Bank offers two choices of account, both of which are exclusively managed through the app. The names of these accounts will make it clear which one you need. If you trade overseas you can also add a € account for £2 per month, or a $ account for £5 per month.

Starling Sole Trader Account

No monthly fees to run, and you can use the app to capture receipts for tax purposes. The app offers bookkeeping services through the Small Business Toolkit bolt-on charged at £7 per month, or you can link your Starling Bank account to a QuickBooks, Xero, or FreeAgent subscription.

Starling Business Account

As above, but intended for use by small business owners that operate an entity listed on Companies House.

Business overdrafts

Starling Bank offers business overdrafts between £1,000 and £50,000. While your business will be responsible for this lending, you will need to make a personal guarantee in case you fall behind on repayments.

Business savings accounts

Starling Bank offers a one-year fixed rate savings bond. Deposit between £2,000 and £1,000,000 and receive a guaranteed interest return of 2.5% upon maturity of the bond after 12 months.

Starling Bank at a glance

| Phone number | 020 7930 4450 |

| App downloads | iOS; Android |

| Website | www.starlingbank.com |

| Number of branches | N/A |

| FSCS protected? | Yes |

| Founded | 2014 |

Starling Bank business loans

Starling Bank offers business loans between £25,001 and £250,000 to SMEs – sole traders are not eligible for this lending stream. While your business will be responsible for this loan, you will need to make a personal guarantee in case you fall behind on repayments.

Starling Bank reviews

What are other business banking customers saying about Starling Bank?

| Review platform | Score | Number of votes |

|---|---|---|

| TrustPilot | 4.3/5 | 33,704 |

| Feefo | Not reviewed | N/A |

| Reviews.co.uk | Not reviewed | N/A |

| Smart Money People | 4.95/5 | 26,769 |

| Which? | 5/5 | 1 |

| Average score | 4.75/5 | 60,474 |

Starling Bank business eligibility criteria

Starling Bank does not reveal their official criteria for approving or declining an application for a business account, but a soft credit check will be run, so consider applying elsewhere if you worry that you will fail this. As always, you will need to provide proof of your identity, address, and UK taxpayer status, and answer some questions about your business model.

Starling Bank business finance alternatives

Compare Starling Bank to any challenger and you will likely find that this provider comes out on top. Starling Bank predates the likes of Monzo, Tide, Countingup, and Mettle, but it more than holds its own against these upstart competitors in terms of product selection and pricing.

Starling Bank additional considerations

Starling Bank scoops up industry awards at a rate of knots. Check the official page of accolades presented to this bank to see for yourself.

FAQ

Yes, Starling Bank is a proper bank. It is authorised by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority (FCA), meaning that it is subject to all of the same regulations as traditional banks in the UK. Its deposits are also protected up to £85,000 by the Financial Services Compensation Scheme (FSCS). All of these measures give customers the same level of protection as they would with any other UK bank.

Opening a Starling Bank business account is easy. You will need to provide some basic information, such as your name, address and company details, before you can apply. Once your application has been accepted, you will be able to access the bank’s mobile app and manage your finances through their secure online portal.

Starling Bank does not charge any monthly fees for its business accounts. There are also no minimum balance requirements and you can withdraw funds and make payments with no extra costs. However, there may be charges for certain foreign currency transactions, depending on the type of transaction and the currency involved.

Starling Bank offers a range of services to help businesses manage their finances. These include online banking, invoice management and payment services, as well as access to business loans and overdrafts. The bank also provides tools such as cash flow forecasting, budgeting and expense tracking to help businesses better manage their money. Additionally, there are various third-party integrations available, such as accounting software and e-commerce tools.

Yes, you can link your Starling Bank business account to other bank accounts. This allows you to easily transfer money between accounts and manage your finances in one place.

Starling Bank accepts a range of payment methods, including Visa and Mastercard debit cards, Apple Pay and Google Pay. The bank also offers international payments, direct debits and standing orders. Additionally, businesses can use the Starling Bank app to accept card payments from customers in person or online.