As one of the “big four’ in British banking, just about everybody will be familiar with NatWest’s iconic branding.

While, like many banks, NatWest has closed a great number of high street branches in recent years, this remains a genuine monolith in the world of business finance, with a particularly impressive range of lending streams available to business customers that will appeal to every income level.

Featured pro tools

The interest rates offered to business savers by NatWest are not the most impressive on the market, but there is still plenty to enjoy about this financial institution if you’re looking to entrust your business income to one of the biggest names in the game, regardless of the size of your annual turnover.

NatWest business banking services

- Pros and cons

- Business current accounts

- Business overdrafts

- Business savings accounts

- NatWest at a glance

- NatWest Bank business loans and finance

- NatWest reviews

- Business eligibility criteria

- Business finance alternatives

- Additional considerations

- FAQ

Pros and cons of NatWest for business services

| Pros of NatWest | Cons of NatWest |

|---|---|

| ✓ Start-ups bank free for 18 months | ✗ Many branches are closing |

| ✓ No monthly account fees | ✗ Microtransaction fees apply |

| ✓ Lots of lending streams are available | ✗ Poor to average online reviews |

| ✓ FSCS protected | ✗ Savings interest is better elsewhere |

Business current accounts

NatWest offers two business accounts, both of which offer free access to the HMRC-approved bookkeeping software FreeAgent and will not charge a monthly account fee.

A business that has been trading for under a year and has an annual turnover below £1,000,000 can apply for a Start-up Account, which offers 18 months of free banking. Anybody else will need to apply directly for a generic Business Account with no free period.

NatWest business accounts also accrue microtransaction charges once you are outside a free billing period. These break down as follows.

| Type of transaction | Fee or charge |

|---|---|

| Automated credits and debits | 35p per transaction |

| Cheque credits | 70p |

| Cheque debits | 70p |

| Cash paid in or out | 70p per £100 |

If you want entirely-free banking consider Mettle, NatWest’s online-only challenger arm. This account is free to open and devoid of microtransaction fees, but does not offer branch support or access to access to an overdraft or other lending.

Business overdrafts

NatWest offers business overdrafts up to £50,000. Interest rates and set-up fees will be discussed upon a successful application, though expect an interest rate of around 13.65%.

Business savings accounts

NatWest offers three choices of savings account to business customers:

Business Reserve

An instant access account with no minimum or maximum balance. Interest is calculated daily and paid on the last trading day of every calendar month. Balances below £10,000 accrue interest at an AER of 1%, while balances over £10,000 gain interest at an AER of 1.26%.

Treasury Reserve

Pay savings into account and earn interest daily based on the national market – interest rates will be discussed and agreed upon application. These will be fixed savings bonds, so you will not be able to access funds until maturity.

If you wish to secure your funds for six days or less, the minimum deposit is £500,000. This drops to £250,000 if you save for up to 27 days, and £10,000 if you enter a bond for longer than this.

Liquidity Manager

A simpler savings account with no minimum balance. Save any sum and give 35 days’ notice before making a withdrawal to earn interest at an AER of 1.61% – calculated daily and paid at the end of each month – or provide 95 days’ notice for an AER of 1.97%.

NatWest at a glance

| Phone number | 0345 788 8444 |

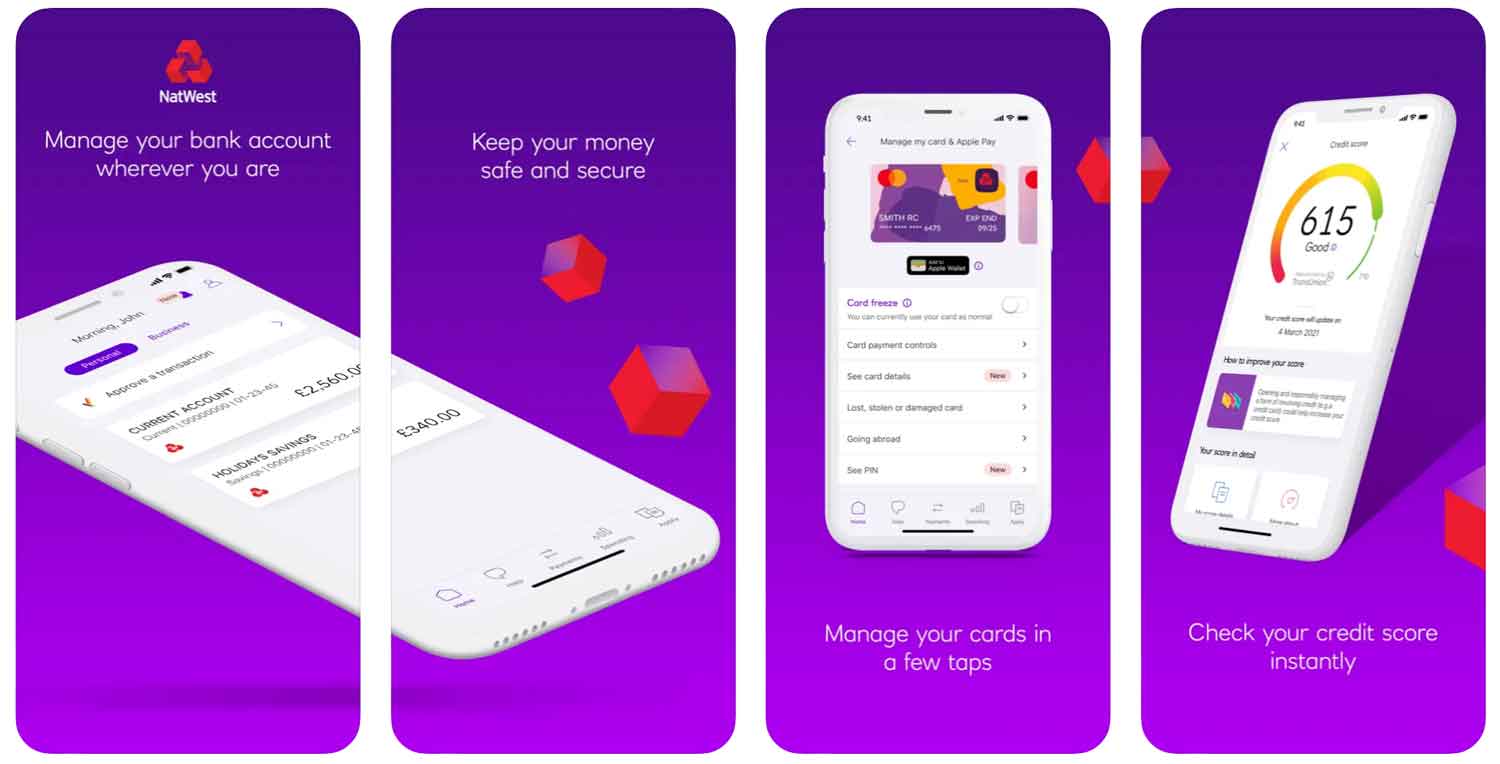

| App downloads | iOS; Android |

| Website | www.natwest.com/business |

| Number of branches | 678 |

| FSCS protected? | Yes |

| Founded | 1968 |

NatWest Bank business loans and finance

In addition to business current accounts and savings accounts, NatWest offers the following products to business customers:

- Business Credit Card

- Business Credit Card Plus

- OneCard

- Small Business Loan

- Fixed Interest Rate Loan

- Variable Rate Loan

- Invoice Finance

- Asset Finance

- Green Loans

- Commercial Mortgage

- Real Estate Finance

Business Credit Card

A standard NatWest business credit card for SMEs and sole traders with an annual turnover below £2,000,000 per year, charged at £30 per year (free for 12 months and waived if you spend more than £6,000 in a year) with a representative APR of 24.3%.

Business Credit Card Plus

A NatWest business credit card for SMEs and sole traders with an annual turnover above £6,500,000 per year, charged at £70 per year with a representative APR of 29%. This credit card accrues cashback on spending, capped at £600 per year.

OneCard

For SMEs and sole traders with an annual turnover above £2,000,000 per year, charged at £45 per year with monthly interest of 1.6%. Spending limits can be set on this card, and holders can use their OneCard to add funds to a NatWest business bank account as well as spend.

Small Business Loan

Borrow between £1,000 and £50,000 on a fixed interest rate for up to seven years. Representative APR is 12.35%.

Fixed Interest Rate Loan

If you need larger sums, apply for a loan between £25,001 and £10,000,000, to be repaid over 3, 5, 7, 10, 15, 20, or 25 years. These loans may need to be secured against an asset. There will be no early exit fees if you wish to repay your loan early.

Variable Rate Loan

Borrow any sum above £1,000 with no upper limit, with repayments based on the NatWest base rate of interest. Repayment holidays are available, and there will be no early exit fees if you need to settle your balance early.

Invoice Finance

Release up to 90% of the value of an outstanding invoice, receiving the remaining balance due – minus a fee – from NatWest once your client or customer settles their account.

Asset Finance

Turn to NatWest via Lombard to finance a major asset investment for your business, leasing the asset with the option to purchase at the end of a hire term, or to gain a share of any resale value if the asset is no longer required.

Green Loans

Borrow from £25,001 at a fixed or variable interest rate to invest in ecologically friendly, sustainable business practices.

Commercial Mortgage

Purchase a trading premises for your business by taking out a mortgage for up to 25 years.

Real Estate Finance

Borrow upward of £50,000 to refurbish or develop investment properties under your business umbrella, repayable for up to 20 years.

NatWest reviews

What are other business banking customers saying about NatWest?

| Review platform | Score | Number of votes |

|---|---|---|

| TrustPilot | 1.4/5 | 4,688 |

| Feefo | Not reviewed | N/A |

| Reviews.co.uk | Not reviewed | N/A |

| Smart Money People | 3.10/5 | 155 |

| Which? | 3.5/5 | 1 |

| Average score | 2.67/5 | 4,844 |

Business eligibility criteria

NatWest will ask for proof of your identity and trading address when applying for a business account, and will ask some questions to ensure that your business model is not deemed too risky. If you’re interested in opening a NatWest business bank account, it’s best to do so in person at a branch – online applications can take several weeks to complete.

Business finance alternatives

NatWest products are virtually identical to those of the Royal Bank of Scotland as these two high street behemoths are part of the same parent group, making this seem like the most obvious alternative.

Equally, businesses in Northern Ireland could approach Ulster Bank, which is also part of the NatWest group family. Barclays and Lloyds round out the “big four” high street banks, or you may wish to consider a smaller alternative like Metro Bank or the Co-Operative Bank.

Additional considerations

With environmental considerations in mind, NatWest has begun the process of ending loans to businesses that work with fossil fuels. This decison to prioritise the future of the planet over easy profits will be welcome news to many.

FAQ

Yes, NatWest is a proper bank. It is part of the Royal Bank of Scotland Group and has been providing banking services for more than 300 years. It offers a range of products, including current accounts, savings accounts, mortgages, credit cards and loans. It also provides online and mobile banking services to its customers. NatWest is regulated by the Financial Conduct Authority (FCA) and is a member of the Payment Services Directive, which ensures that customers’ money is protected. NatWest has received multiple awards in recognition of its commitment to customer service and innovation. As such, it can be considered a reliable and secure banking provider.

Opening a NatWest business account is easy and can be done online. For businesses that prefer to open an account in person, there are branches located throughout the UK. Before applying for a business bank account, it’s important that you have all the necessary documents ready such as your company name, registered address and articles of association (if applicable). Additionally, there may be some additional requirements depending on the type of business you have. Once you’ve gathered all the necessary documents, you can submit your application online or in person.

NatWest offers several business banking accounts, each with different fees and charges. Generally, there is an annual account fee which can range from £5 to £30 depending on the type of account you open. Additionally, NatWest may charge transaction fees for certain types of payments such as Standing Orders or Direct Debits. There may also be charges for additional services such as overdrafts or international transfers.

NatWest offers a range of services to businesses, including current accounts, savings accounts, mortgages, credit cards and loans. Additionally, NatWest provides online banking services which allow customers to manage their accounts from their computer or mobile device. NatWest also offers business support such as financial advice and guidance on taxation matters.

NatWest accepts a variety of payment types, including debit cards, credit cards, wire transfers and direct debits. Additionally, NatWest also offers online payment services such as Apple Pay and Google Pay. Customers can also use their mobile devices to make contactless payments in-store with NatWest’s mobile banking app.